Monday, February 28, 2022

SYSTEM TEST PENDING

Friday, February 25, 2022

The Crime Of The Century

Never in history have so many people been conned at the same time...

Today's bulls have now bought the war in Ukraine, extreme Fed tightening, China Implosion, Tech Wreck, and cycle high inflation with both hands. Which makes them fully complicit in what will soon be revealed as the crime of the century.

Why the crime of the century? Because when this hot air bubble explodes, there will be NOTHING left to show for it. Corporations will be mass insolvent, households will be mass insolvent, state and local will be insolvent and many global governments will be insolvent. It will be a very hard landing back to the zero bound with non-existent monetary stimulus. The liabilities that attend this delusion will remain at all time highs while the assets collapse. Of course when Fed and Congress are trading stocks along with everyone else, then it's easy to overlook the level of chicanery accompanying this sugar bubble. Nevertheless, the level of widely accepted fraud and criminality in this era exceeds all other recent economic cycles combined. The pandemic spawned a late cycle blow-off top in speculative mania which unleashed unfettered greed, fraud, and corruption. The fullness of time will reveal this sugar rally to have been a fool's rally of epic proportion. One by one all of the global markets are collapsing back below the 2020 pre-pandemic high: Chinese/Hong Kong stocks, Biotech, Fintech, Global IPOs, Ark ETFs, now German stocks are flirting with breaking the 2020 support level.

This week, the impending war in Ukraine caused a global selloff earlier in the week and then the actual start of the war got bought with both hands. Optimists could point to the 2003 analog when the war in Iraq ended a recession and sparked a massive global rally. On the other hand, the 1990 analog was a war and oil shock that exacerbated a nascent recession. Which story to believe?

We can see via consumer sentiment that this era bears greater resemblance to 1990 and 2008 than the Y2K recession-lite scenario. However, there are far more risk factors to consider - as listed in the graphic above.

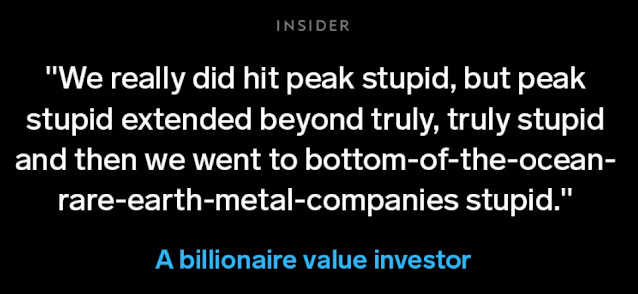

Why these people are still living in the 1970s is beyond all comprehension. It's as if they don't remember the sequence of events that took place during the 40 years since that time. Or they don't want to remember. In any case their inflation hysteria has now reached lethally binary proportions.

Commodities are now FORTY years overbought. Today's pundits haven't the slightest clue how fast the inflation premium can disappear from this market. The fact that nominal commodity prices are lower than 2008 has somehow escaped the attention of ALL of today's complicit pundits.

I and a few others remain of the minority opinion that buying ALL of these risks only serves to amplify the final explosion.

That said, my theory has yet to be detonated.

Up until 2022, bulls operated under the steadfast belief that only monetary policy matters. Now that monetary policy is working against them, they are under the belief that nothing matters.

There are currently NO risks priced into this market:

S&P futures net speculative as % of open interest ended the week at CYCLE HIGH:

Clearly, today's stock bulls have zero clue how close we came to global meltdown this week:

"Equity positioning showed "zero signs of capitulation despite flows and price disconnect"

Among notable flows, investment grade, high yield and emerging market debt saw a seventh consecutive week of redemptions"

In summary, history will say the crime of the century took place in broad daylight, because criminality was de-regulated.

Go figure.

Tuesday, February 22, 2022

Global Margin Call

Sunday, February 20, 2022

The End Of Disney Markets

There's no question the pandemic created wealth for the ultra-wealthy - at the expense of everyone else, which is how all Ponzi schemes work. There is a period of time during which asset flows provide the illusion of wealth for everyone. Which keeps them drawing in new cash. For the all time record, 2021 drew over two decades' worth of new cash into the casino:

Wednesday, February 16, 2022

Don't Look Down

The Netflix movie, "Don't Look Up", is a timely analog for the monetary euthanasia that has a death grip on society. Fortunately, this impending reset won't be a world ending event. But for consumption addicts forced to go cold turkey, it will feel like it anyways...

I finally got around to watching "Don't Look Up", which is essentially a slightly more intelligent version of "Idiocracy" i.e. a society of idiots hellbent on self-destruction. A very timely movie clearly targeted at climate change, but equally relevant to all other aspects of society that are currently imploding in broad daylight amid mandatory denial. Since the pandemic collapsed the carbon level down to decade lows, I've started worrying more about this society's latent mental breakdown than the environment. Why? Because once this monetary illusion implodes, the overall carbon level will collapse like a cheap tent.

Case in point, in the same week we learned that consumer confidence has collapsed, we learned that retail sales are skyrocketing. This only makes sense in a society of hoarders fretting about inflation while their overall sense of economic confidence implodes. These people are hoarding merchandise going into a deflationary depression. Something we never saw in 2008. It goes without saying that the hangover will be brutal.

But really, who could warn them?

This hoarding/asset bubble scenario has created the perfect set-up for a bidless market and the fastest demand collapse in modern history. There is no way this could be more cataclysmic than this unique combination of idiotic events.

As we see below, the inflation hypothesis is now universal consensus. Even though at this latent juncture neither gold, nor oil, nor Treasury bonds are confirming it.

On the subject of timing, we have now entered the ninth consecutive week of short-term treasury bond yield rise. The last time we saw that was back in February of 2000. Which made me realize that the set-up now is eerily reminiscent to that one. Back then, the Fed kept the spigots open through the Y2K date change because they were worried the world was going to end, computers offline, planes falling out of the sky etc. When all of that turned out to be a non-event, the stock market bolted higher. At that point, the Fed realized they were way behind the curve on tightening policy. So what did they do, they started hiking rates as fast as possible. And then by March 2000 the Tech bubble exploded. Which when you think about it is very similar to the current scenario. The Fed has been preoccupied with the pandemic and the various mutations. Which left them way behind the curve as supply bottlenecks grew and pent-up demand exploded. So now, in this new year they're making up for lost time.

The main difference is of course that now yields are far lower than in 2000 because that was the strongest economy in decades. Whereas this is the weakest economy in U.S. history. In Y2K, GDP growth was at 7% and the U.S. budget was in surplus. Now, GDP growth is at 2% and the deficit is 6%. In any other era that would have been considered a 4% recession.

Putting it altogether and we now have end of cycle inflation hysteria worse than 2000 and 2008, attending a 100 year asset bubble. Which means double policy error. However, the populace is far more concerned about the price of eggs than sky high asset prices. One is expensive short-term. The other costs everything long-term.

Once the global margin call reaches its crescendo, there will be no possibility for central banks to stop it. The Fed is now boxed in by the lethal inflation narrative. In 2008, it took four months and -40% for the Fed to arrest the decline of the stock market. Albeit there were some massive short-term rallies along the way.

Today’s pundits are 100% convinced the Fed can save every market despite the fact that the collapse is already well underway.

In summary, the consumption-addicted masses are now hoarding insolvency heading into a depressionary asset collapse. On the other side of which there will be a glut of EVERYTHING. Which is apropos for a society that trusts opinion over fact every single time without the slightest question. A society of dedicated denialists placing ALL faith in their overwhelming strength of numbers.

On the topic of the casino, this week the Nasdaq has round-tripped back to the high of last February, while breadth has collapsed for a YEAR straight:

Since the top on January 5th (yes my birthday), the Dow is declining faster than it did in 1987. Today's Dow has already tested the 200 dma three times. Back then, a solid break of the 200 dma is when the crash got out of control.

Rally volume as we see has been abysmal:

The broad based Wilshire has the clearest wave form. It peaked back in November and it's now exhibiting nested "1s" and "2s". This is my interpretation and it implies the most bearish of outcomes.

Suffice to say, bulls can't afford for this to be accurate, because it implies the end of mass delusion.

Don't look down.

Tuesday, February 15, 2022

Goodbye To All That

Thursday, February 10, 2022

Global Coordinated Meltdown

"A dramatic week of central-bank meetings and economic data has changed the game for global rate-hike bets"