The only thing more dangerous than gamblers who believe bear markets no longer exist, are economists who think recessions no longer exist. One thing they all have in common is the belief that printed money is the secret to effortless wealth. The only question they ALL have is, why did no one try it sooner?

For months last year pundits pounded the table that inflation is NOT transitory. Last December the Fed finally agreed, and they slammed on the brakes. Six months later pundits are now saying inflation IS transitory. Stagflation in the 1970s lasted almost six years from 1974 to 1980. This time around it lasted six months. Which begs the obvious question, what is the definition of transitory?

The answer is it no longer matters, because per tradition the Fed is heading in the wrong direction and this clown car doesn't go in reverse. We don't know if the economy is in recession right now, we only know it's on a slowing trajectory. Which means we are headed for recession and the Fed is accelerating towards the cliff. There is a consensus belief among pundits that the Fed can raise rates to the "neutral" level this year ~2.5% and then start cutting rates next year, all while avoiding recession in the meantime. In other words, the Fed will create monetary buffer by demolishing economic buffer. When they fail, the consequences will be cataclysmic. First the financial bailout will fail. And then the economic bailout will fail. Monetary policy is now a spent farce.

This recent Fortune article basically sums up the standard view:

Fortune May 2022:

There Are Two Kinds of Recessions. The Good Kind and The Bad Kind. We Deserve The Good Kind:

“It typically takes about 10 months from the low in unemployment to recover to pre-recession employment levels in a typical recession,” Miran said. “For the dot-com [bubble] and the global financial crisis, it took about three times that amount, about 32 months, to recover to pre-recession unemployment levels.”

There are many things wrong with this article. It starts off by assuming there is NO asset bubble this time around. Which is obviously an asinine assumption. We learned today that home prices surged 20% in March. Which is a Black Swan event with a 1 in 420 probability based on known data alone.

"March’s reading was the highest year-over-year price change in more than 35 years of data"

We have a parabolic housing bubble AND a collapsing Tech bubble, this time with no safety net beneath the economy. Yet both gamblers AND economists are convinced this bear market and this recession will be the easiest of the three. You have to be brain dead to believe this bullshit, which is why it's largely unquestioned.

The article makes an even more fundamentally flawed and asinine omission when they claim that typical recessions don't last very long and are not as bad as 2008. Because what they fail to mention is that the Fed lowered rates between 5 and 10% in every recession of the past 50 years. Currently the Fed has less than 1% dry powder. So how is it possible to have a "garden variety" recession when the Fed has nowhere to go on rates?

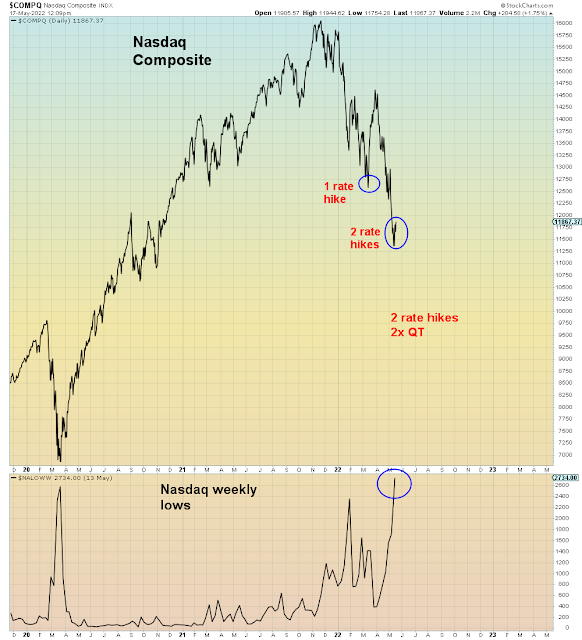

What you notice from this chart is that every recession required the Fed to dramatically cut rates. EXCEPT the pandemic, because they only had 2.5% to go on rates.

What saved the economy in 2020 was the largest fiscal expansion since World War II MONETIZED by the largest Fed balance sheet expansion on record.

The bet now is that will happen again during a mid-term election:

In summary, we are heading for a very hard landing.

Whether stocks lead or follow is NOW totally irrelevant. The economic damage is done and the Fed no longer has any rate cut powder. This consensus view that they can head off catastrophe by tightening faster, is a LETHAL assumption.

Which means we are now facing simultaneous deleveraging in tech stocks, housing, consumption, corporations, state and local governments, emerging markets, all at the same time.

When the financial bailout fails and markets implode there will be no appetite to bailout out the wealthy. In addition, fiscal stimulus will be insufficient in a mid-term election year heading for political gridlock.

The belief that printed money is the secret to effortless wealth has reached Terminal Idiocracy. Today's pundits claiming there will be a "soft landing" are borderline criminal. And the complacent masses wouldn't have it any other way.