"Since the 2008 global financial crisis, American corporations have taken advantage of historically low interest rates to gorge themselves on debt. Then came the pandemic and the sharpest economic downturn in history, which resulted in an odd solution for the companies that did all that borrowing: more debt"

Wednesday, September 30, 2020

Reaching The Minsky Moment In Trump Casino

"Since the 2008 global financial crisis, American corporations have taken advantage of historically low interest rates to gorge themselves on debt. Then came the pandemic and the sharpest economic downturn in history, which resulted in an odd solution for the companies that did all that borrowing: more debt"

Tuesday, September 29, 2020

The New Permanent Plateau of Delusion

This is the largest misallocation of capital in human history...

I mean easy money:

This podcast/article, below, gives a good summation of the perverse incentives driving money managers to overdose on ludicrously overvalued Tech stocks. I would first point out that it's not their money. I don't normally listen to podcasts, but I found this one quite interesting, as it touches on topics ranging from asset bubbles to economic ideology. It kicks off noting that all risk asset markets have converged upon an identical left to right upward slope. Meaning they are massively correlated. Including so-called safe havens such as gold. Then it asks the critical question, what would it take for the Tech/deflation bubble to implode. Somehow never once wondering if it's imploding right now. Then, the usual historically illiterate question, how long will it take for the economy to float back from China? At which point the discussion segues into the philosophical question as to whether or not today's monetary assisted robber barons have perverse incentive to keep the central bank spigot attached to their Cayman Island bank accounts permanently.

My answer: Only until the riots get out of hand.

"These days it seems like all financial markets are the same big trade. A gold chart looks like a Tesla chart, which looks like an Ethereum chart, which looks like a chart of a basket of cloud computing stocks. So why is this? And what could cause that to change? "

Indeed. Let's contemplate this question:

One hypothesis floating around Zerohedge is that investors are TOO bearish ahead of the election, which is putting a floor beneath the casino. Every selloff is met with short-covering or options monetization, the derivative version of short-covering.

I would agree that high amounts of bearishness among institutional investors has kept this gong show going longer than expected. Because other than short covering, there is literally no bullish case for owning stocks right now other than to pray that an even bigger dunce will come along later. A risky bet that many have made but no one has ever collected upon.

Fortunately, as stocks have now fully decoupled from reality, into this new permanent plateau of economic implosion, Wall Street will continue dumping multi-year record amounts of junk IPOs, until something explodes. Putting some amount of certainty back into this equation:

"At this point, only hermits without WiFi would be unaware that 2020 is the busiest year for IPOs since 2014"

Recall that late September 2014 was when the Alibaba IPO crashed the U.S. market. Now we are waiting for Alibaba's Fintech spinoff "Alipay" aka. Ant Financial will crash Asian markets any day now. In the meantime, Wall Street is front-running the global RISK ON party.

Among the stock market bubbles that have not yet imploded this time around, today Solar/Alternative Energy stocks went late stage parabolic:

Looking at out of the money crash bets, here we see that the September stair step lower has seen crash bets decline, as the weak bears got monetized.

It's called capitulation.

The large cap momentum trade is sporting a double a-b-c zig zag on the hourly. Both are Elliott Wave "flats" meaning that the origin for wave c is the same level as wave a, which is highly unusual and extremely weak.

Monday, September 28, 2020

MAGA Is A Spent Farce

Friday, September 25, 2020

Disney Markets For The Fall

COVID Is The Solution, Not The Problem

Thursday, September 24, 2020

Doubled Down. On The Bigger, Fatter, Uglier Bubble

"Trump's intransigence, included in his latest assault on perfectly legitimate mail-in ballots on Wednesday, posed a grave threat to the democratic continuum that has underpinned nearly 250 years of republican government"

So far this week the BTFD team has been buying every dip, amid an accelerating decline.

Tuesday, September 22, 2020

Feels Like Fall 2008

It's the end of the cycle, which means a 2008-style credit crisis is imminent. Unfortunately, today's criminalized financial pundits can't admit that fact, because that would doom the MAGA Kingdom, and the greatness that derives from following lying circus clowns...

This period of mid-September to mid-October ahead of the 2008 presidential election, was the third wave. Down...

Any questions?

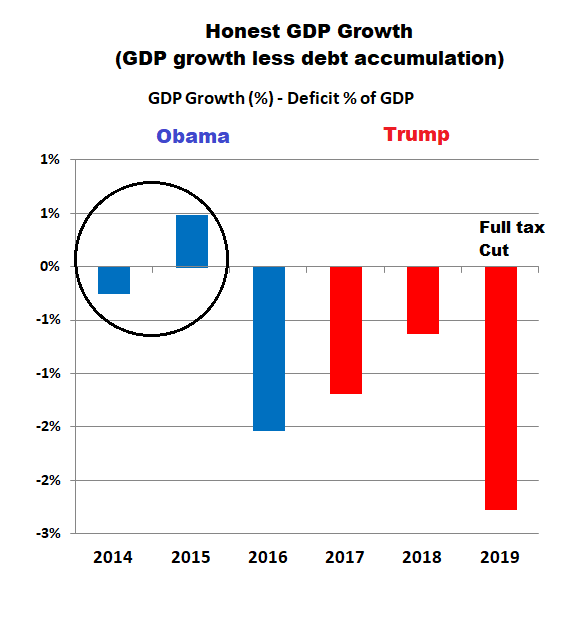

There are only two kinds of people in this world right now, realists and denialists. MAGA fiends of course are not the only denialists, merely the most dedicated. At present, denialists outnumber realists by 100 to 1. Of course things were actually going far better in late September 2008 than they are right now. Never before has so much stimulus been used to hide a depression as right now. A 15% of GDP deficit to achieve -5% GDP growth. Because we have to be in a recovery, otherwise the MAGA Kingdom is doomed. This is our "future", using ludicrous levels of stimulus to pretend that recessions no longer exist.

The Fed was just as clueless back in September 2008, however they still had ample fire power, which is not the case now.

NY Times

How the Fed misread the 2008 Crisis

"On the morning after Lehman Brothers filed for bankruptcy in 2008 [Sept. 15th, 2008], most Federal Reserve officials still believed that the American economy would keep growing despite the metastasizing financial crisis...the Fed’s policy-making committee voted unanimously against bolstering the economy by cutting interest rates"

Then the wheels came off the bus, and the rest is history.

Historians will never understand the level of complacency taking place right now. Of the many differences between then and now, one key difference is this massive speculative bubble which is unraveling in real-time. Another key difference is the number of weekly jobless claims which has exceeded the maximum 2008/2009 levels EVERY week since March.

It's insanity. As usual.

Which gets us back to Trump Casino:

Monday early morning (~3am Eastern), the futures had been idling along fairly flat, and then all of a sudden they imploded just prior to the European open. Global banks got pole axed by allegations of widespread money laundering taking place over the past two decades.

Monday's U.S. session gapped down at the open which was followed by the obligatory all day BTFD rally. However, the buying was confined entirely to the Tech sector, as the other 10 out of 11 sectors were all down. Ex-Tech, it was a 90% down day. Desperate speculators are now throwing caution to the wind and piling into the last vestiges of the Tech stay-at-home rally.

I listened to a Tech stock analyst on Bloomberg yesterday who sounded like she was not around in Y2K. From what I could tell, she was in kindergarten. She was recycling the same false platitudes that were deployed in that era to keep the bubble going. Tech is the future, there is no future without Tech, valuations don't matter etc. For those of us around in that era, it was all a massive lie to accompany a massive pump and dump of junk IPOs. Similar to what is taking place right now.

Among the leading stocks yesterday, as usual was Tesla, the continuing leader by far in Nasdaq active dollar volume. However, today is the Tesla shareholder meeting aka. "Battery day". After the close last night Elon Musk tweeted that most of the new innovations are two years away from being monetized. Which is why the stock is selling off pre-market. As we know, Tuesday's are the best day of the week in Trump Casino. So anything can happen.

That said, WHEN not IF Tesla rolls over hard, it will final implode the Nasdaq:

But here is the big difference between now and Y2K:

In this era, the so-called safe haven stocks are the weakest stocks in the casino. Which means there are no safe havens outside of cash aka. money markets/t-bills. T-bills being the safest on a relative basis.

Here we see on the S&P 500, using February as a guideline, a gap down Monday and then the 200 day was taken out by the end of that week.

This is not a prediction, merely an observation that the casino is heading in the same direction, at the same rate. This time, I doubt the 200 day will hold for as long as last time. We will soon find out.

For those who are wondering how close we are to a bottom so they can play the Ponzi Casino from the long side, I suggest not yet.