"Numerous experts have predicted not to expect a housing crash like in 2008, given that the current market is so different"

Sunday, October 10, 2021

The Wall Of Shame

"Numerous experts have predicted not to expect a housing crash like in 2008, given that the current market is so different"

Wednesday, October 6, 2021

The China Lehman Moment

Friday, October 1, 2021

A Gong Show Grand Finale

Never before have greatest fools and Nobel economists been in such cozy intellectual consensus. A combination of factors are coalescing to ensure that this crash is the one that pulls back the curtain on this central bank con job. This impending magnitude of dislocation will ensure everyone realizes that transparent criminality is profound evil packaged as virtue...

"So our wisdom, too, is a cheerful and a homely, not a noble and kingly wisdom; and this, observing the numerous misfortunes that attend all conditions, forbids us to grow insolent upon our present enjoyments, or to admire any man's happiness that may yet, in course of time, suffer change. For the uncertain future has yet to come, with every possible variety of fortune; and him only to whom the divinity has continued happiness unto the end we call happy; to salute as happy one that is still in the midst of life and hazard, we think as little safe and conclusive as to crown and proclaim as victorious the wrestler that is yet in the ring"

- Solon by Plutarch

Former hedge fund manager Hugh Hendry warned back in late 2014 that central bank alchemy would have a Keynesian body and an Austrian tail. Meaning that it would last long enough to convince the masses that it was working and then it would final monkey hammer them at the end. It would all end in tears at some "unknowable" time in the future. He was right. Despite the roller coaster ride since 2015 when China's last bailout failed, the S&P 500 has churned out new highs, sucking in the capital and the dreams of those who have complete confidence in record alchemy. Drugged by the virtual simulation of prosperity and its acolyte QE. Central banks being nothing more than monetary drug dealers administering euthanasia to the zombified masses.

It's clear that gamblers still haven't figured out that 0% interest rates imply 0% real economic growth. Or maybe they don't care that all returns are a zero sum game. Only their own RECORD misallocation of capital has been driving this Ponzi market ever higher. All convinced in this zero sum game that they will cash out for maximum profit. Unfortunately, they will all soon realize that the only thing more painful than wasted money, is wasted life.

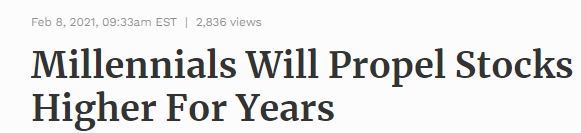

So what are these "unique" risk factors that I speak of. First and foremost, Millennials discovering investing at the end of the longest cycle in U.S. history are the biggest single risk to these markets. We already saw a glimpse of this earlier this year during the Gamestop debacle. ALL of the major online brokers experienced outages when that pump and dump scheme exploded. Pundits described it as the "democratization of markets". They extolled the boiler room on Reddit as the "future" of markets.

"A message board destroys a top Wall Street hedge fund. You’ve surely heard about the WallStreetBets/GameStop saga by now. Many investors see it as a sign markets are headed for a crash"

Google searches for “stock market bubble” just hit the highest level ever. And a new E-Trade survey found two-thirds of investors think the market is in a bubble"

Then he goes on to explain how this is all very bullish. Of course he has been right so far in 2021, although September just recorded the worst month since March 2020. We saw this same pattern back in 2018. Google trends "stock market bubble" peaked in February and was trending lower when the market unexpectedly tanked in the fourth quarter. The same pattern is happening now.

Meanwhile, the amount of dislocation we saw back in February vis-a-vis online brokers was unprecedented even relative to the COVID collapse in 2020. A single stock pump and dump scheme caused more dislocation than a global pandemic.

Here in this chart below, I use Ameritrade as an example, but ALL of the online brokers experienced volume-related outages back in February and March of this year. Even more so than in 2020. Why? Because of the massive volumes of newbie traders democratizing pump and dump schemes.

Millennials have never seen a bear market before, which is why they believe that down markets and margin calls are mere folklore. They are convinced they can ride out any market on maximum leverage. All they need to do is double down and ride it out.

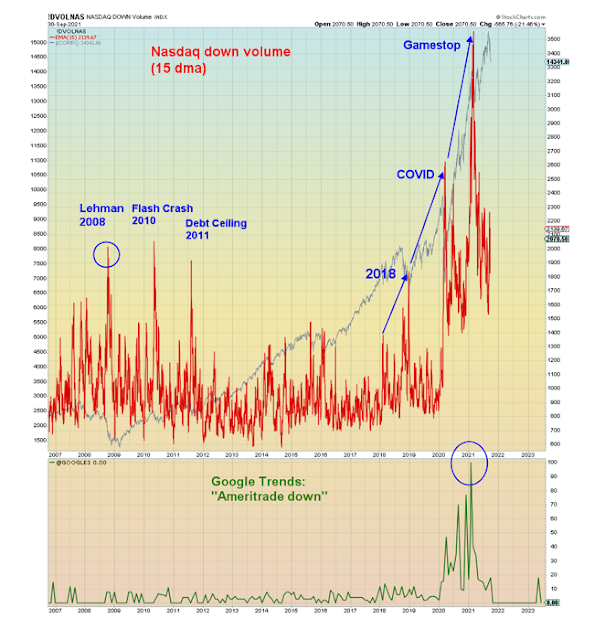

Here we see the equity put/call ratio remains near record lows relative to other major selloffs:

While invincible retail gamblers have been loading up on risk, institutions have been taking down their exposure. This can be seen in this chart of up volume / total volume. The divergence relative to recent all time highs is massive:

In summary, us "perma bears" have been "wrong" all this time while the masses added record leverage to their Ponzi scheme during a depressionary pandemic. This monetary-fueled asset mania coming at the end of the longest cycle in U.S. history has served its purpose of concealing the weakest and fakest economic recovery in history. The CBO predicts that the 2021 Federal deficit will be 13.4% of GDP, while the GDP growth rate will be 7%. Had the same amount of stimulus been applied in past recessions, there would have been no recessions in U.S. history.

Why mass deception is considered good economic policy is not for me to say.

Millennials are nothing more than the latest cannon fodder for Wall Street's massive money machine which thrives on monetizing ignorance. And in this society, there is a bull market in ignorance because the IQ bar keeps going lower, and lower, and lower.

Any questions?

"CNBC Documentaries presents “Generation Gamble,” a comprehensive look at the proliferation of online investing, crypto and sports betting apps and how a new generation is being encouraged to act more aggressively towards money and risk. Reported by CNBC’s Melissa Lee, this hour-long original documentary explores a new era where the boundaries between gaming, betting and investing are blurred, and younger consumers are being targeted"

It's transparent criminality, America's latest business model.

Wednesday, September 29, 2021

Global Warning Ignored

"China has sent a “clear message” over its disapproval of expansionary monetary policies, especially the asset purchases widely favoured in major Western countries"

"It's surprising the timing of this," Shiller said. "It came starting in a recession. We're supposed to be depressed and yet we seem to be exuberant in the market."