Monday, August 22, 2022

GLOBAL LIQUIDITY TRAP

Saturday, August 20, 2022

AN OVERBOUGHT COLLAPSE

The Fed needs markets to capitulate to get to neutral, but markets are anticipating neutral so they never capitulate. In the meantime rates keep climbing...

The seeds of this disaster were planted over a decade ago when the Fed switched from interest rate based policy to balance sheet policy at the zero bound. Over the past 14 years they've been using financial markets to manipulate the economy, instead of the other way around.

It's totally asinine to believe that a 1.5% interest reduction during the pandemic caused a 9% inflation rate and yet that's exactly what the majority of pundits currently believe.

One year ago at Jackson Hole 2021, Powell made a mistake when he said that inflation was transitory. Back then everyone believed that inflation was caused solely due to the pandemic unemployment fiscal programs. A $300/week unemployment stipend was causing hyperinflation. You would have to be an idiot to believe that, therefore it was consensus view. Only one of the many dunce theories propagated by Zerohedge during the past year. Of course those fiscal programs ended a year ago, which is when inflation accelerated. So in 2022 the Fed hurriedly raised interest rates back to pre-pandemic levels. And here we are with inflation STILL near 9%. Why? Because the Fed balance sheet is too large and the wealth effect is still working its way into the economy via asset markets. The Fed's entire strategy for 14 years has been market based but still market participants think that interest rates control inflation and the economy. We are now in a trickle down fake wealth economy:

August 2022:

"Ferrari has reported record quarterly sales and profits as concerns over the global economy fail to dent the enthusiasm for buyers of luxury trophy vehicles.

The company, the latest luxury or supercar manufacturer to post record profits after Lamborghini and Bentley"

We've seen four consecutive rate hikes of increasingly shocking magnitude, the last two being .75%. Now ANOTHER .75% is back on the table, all because markets have been front-running the Fed again. Which was due to the mistake Powell made in July of this year stating the Fed rate was in the territory of neutral. Now this week, he has to back out of his mistake from last month and from the entire past year.

Which means he is going to club markets like a baby seal.

He is going to crush any hopes of a near-term pivot and in the process he is going to force RISK OFF. His credibility is at stake.

"The chair of the Federal Reserve may have a hard time convincing markets that the central bank is serious about defeating inflation. But he’ll have to try"

Powell must take care to disabuse markets of the notion that the Fed will soon be done tightening monetary policy"

What a lot of people forget is that even the mighty Volcker screwed up forty years ago. He raised rates initially and shocked markets, but then he quickly lowered rates. Which caused inflation to resume. Which is why he had two recessions, one in 1980 and another in 1982 when we was forced to shock markets a second time. Today's Fed members know all this about Volcker history which is why in this week's FOMC minutes there was a discussion around raising rates and keeping them elevated for an extended period of time. Which is the opposite of what stock market bulls expect.

"Some officials indicated that once rates had been raised to the point where they were cooling down the economy “sufficiently”, it would probably “be appropriate to maintain that level to ensure that inflation was firmly on a path back” to the Fed’s target of 2 per cent"

This week, Fed member Bullard reiterated that he sees the Fed rate at 4% this year. Sooner than later. Which would be almost DOUBLE the pre-pandemic interest rate.

Risk markets are now overbought going into the riskiest period of this year and this cycle. On the belief that bailout is imminent. When, nothing could be further from the truth.

This week the Nasdaq 100 reached the most overbought level in history based on MACD. Tied with August 2020 another low volume levitation period. MACD is a momentum indicator based upon the convergence and divergence of two moving averages - one short-term and one long-term. When MACD is high it means that the market is going parabolic and the short-term indicator is moving quickly relative to the long-term trend.

Hedge fund short covering is highly evident in this chart of active manager risk exposure:

In summary, soon all risk markets will be at new lows for the year. And the Fed will be doing nothing about it except waiting for bulls to finally capitulate.

And then when that happens and the machines abiding this low volume illusion go offline, EVERYONE is going to realize that the big mistake didn't start in 2022. It started when investors were systematically conditioned by the Fed to become bailout whores.

With the USD at the highest level in 20 years, the risk of a policy error has never been higher.

Consider that the Fed was cutting rates the last two times the dollar was sky-rocketing in a recession.

And to think, investors are front-running rate cuts in a recession. Which equals a long bear market.

Tuesday, August 16, 2022

ONCE UPON A TIME IN DISNEYLAND

Monday, August 15, 2022

THE TWILIGHT OF GLOBAL PONZINOMICS

The extent of lies bought and believed right now are both pathetic and lethal. There is an entire media industry built around propagating the fantasy of perpetual financial bailout...

And while that is NOT happening, we are not imagining things - the gunfire IS getting closer. Two thirds of the largest mass shootings in U.S. history took place since 2007.

What do we expect this time when the sheeple realize they've been conned all over again by the same psychopaths as last time?

A society in latent moral collapse has no clue it's in moral collapse. What used to be illegal is now common place. Pump and dump schemes used to be prosecuted by the SEC. Now they're deemed "social investing". The only question regulators had about the Gamestop debacle was why did brokers prevent people from fully participating. Social media has weaponized financial Ponzi schemes against newbie bagholders. Stock buybacks used to be illegal, now they're used to facilitate insider selling on an industrial scale. Buybacks hide collapsing revenues at the end of the cycle by shrinking share count to give the illusion of rising profit. Stock buybacks have weaponized passive indexing against retirement bagholders. Record buybacks did nothing to prevent the worst first half for stocks in 60 years.

The U.S. deficit is now fully considered "GDP". 2022 growth is so far negative while the deficit is almost 5% of GDP. In any other time that would be considered a deep recession.

We've now seen the exact same profiteering take place across EVERY major industry since the pandemic. In each case, temporary supply chain interruptions deplete inventories and lead to a spike in demand. Followed by higher prices and expanded profit margins. And then it all collapses. No one says anything. Economists fear a wage-price spiral when what they should really fear is the wholesale collapse of the middle class. Buried by profiteering in every direction.

Home prices rose the most during the past two years in U.S. history. Auto prices have sky-rocketed 30% in two years. Retail inventories are already piling up and it's only a matter of time before the glut is everywhere.

Like now:

"A gauge of New York state manufacturing activity plunged by the second-most in data back to 2001, with sharp declines in orders and shipments that indicate an abrupt downturn in demand"

"The survey likely shows “that industries extrapolated orders from the Covid period and they ordered too much stuff”

We should fully expect that economic data will "surprise" to the downside from this point forward. Today's pundits have a lethal bias towards optimistic predictions and their audience wouldn't have it any other way. This current belief that the Fed won't over-tighten is a sheer fantasy. The Fed already HAS overtightened. The NAHB states that housing affordability is the worst since 2008. The combination of price increases and rate hikes has caused the financing costs of a new home to TRIPLE since 2020.

Still, for now the lying flows like a river in between collapsing data points. Over on Zerohedge, yet another pundit fears the imminent debasement of the currency. What these fools should really fear is the debasement of humanity into Third World squalor while the dollar is sky-rocketing. To believe in the hyper-inflation argument one must first ignore the past 40 years of deflationary debasement at the hands of Supply Side Ponzinomics. This so-called "model" has imported far too much poverty to lead to inflation. We can be fairly certain that the true MMT experiment won't lead to the largest rise in global billionaire wealth on record.

This continual false optimism is what will make this burial even more lethal. Since the Fed began raising rates in .75% increments, financial conditions have eased as investor complacency has increased. It's the law of too many bailouts.

Friday, August 12, 2022

MELTDOWN REPORT 8/12/2022

Despite the fact that the CPI came in weaker than expected, cyclicals enjoyed a major rally this week due to the fiscal stimulus bill that just passed. Will this bill remediate Global Warming? Of course not. But the attendant short covering rally could initiate global meltdown, which will do more to reduce the carbon footprint than any legislation imagined by any government...

Banks rallied this week, despite the flattest yield curve in 40 years.

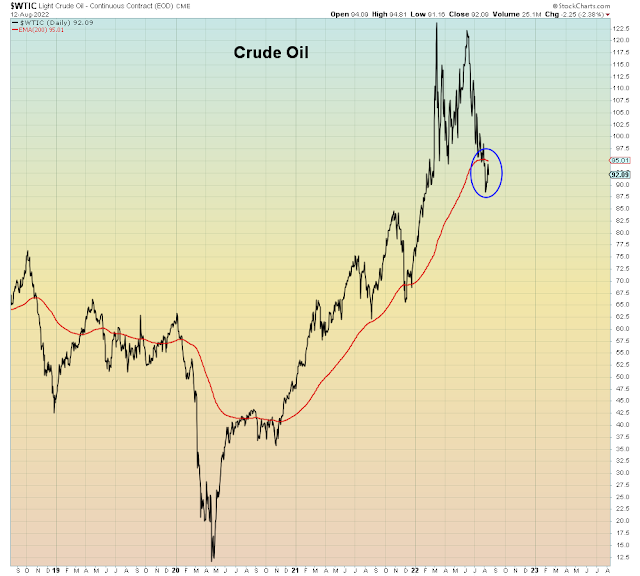

This is the first weekly close for crude oil below the 200 dma since the pandemic started:

Inflationists wrong.

Again.

What is more cynical, to vote AGAINST a bill to finally address Climate Change? Or to vote FOR a bill that is too little too late?

"Once I stood to lose her

When I saw what I had done

Bowed down and threw away the hours

Of her garden and her sun

So I tried to warn her

I turned to see her weep

Forty days and forty nights

And it's still coming down on me"

Wednesday, August 10, 2022

WAITING FOR OFFICIAL BURIAL

By the time the National Bureau of Economic Research finally declares official recession, their astute observation will be only useful to archaeologists attempting to figure out what happened to the deeply buried Kardashian society...

While playing history's greatest central bank following fools, today's gamblers believe that time is on their side. Nothing could be further from the truth. With each passing day the hole gets deeper. But you would have no way of knowing by reading the mainstream financial media. They have a skill at turning all economic risk into gold plated opportunity. If Bernie Madoff was alive he would be head of the SEC.

We have now crossed over into the back half of the year, well into the months (August/September) that have caused the greatest financial dislocation in the past two decades. It appears that for whatever reason, the worst first half stock market performance in 60 years ignited a massive short-covering squeeze. Many hedge funds that were short in the first half decided to book profit. Which means that now currently there is no short buffer below the market:

Bloomberg July 28th, 2022:

BEARS UNWINDING SHORTS LEAVES STOCKS EXPOSED

"The rally, and attendant change in sentiment, has forced speculators to unwind bearish positions that once served as a key source of (stock) demand...With short sellers retreating, stocks might be exposed to a downdraft if the Fed turns more aggressive on future rate increases or corporate profits start to crater"

This implies that there is plenty of room for CTAs to start building up short positions again.”

In other words, shorts covered despite the fact that risks have grown steadily since the beginning of the year. Goldman Sachs started the year with a prediction for four rate hikes in 2022 (1%) and they are currently predicting 16 rate hikes (4%). All Wall Street economic growth predictions have now been updated with minus signs.

We can see the reduction in short positions via the CBOE option skew which is an indicator of short positions in the options market:

Basically what happened since the end of the first half is that bearish money managers took profit while betting the worst was over. When in actual fact the worst hasn't even started yet.

Which is why investors are now praying for recession to get them to their imaginary promised land of a Fed reversal near the zero bound. Their safety net is no longer shorting, their new safety net is believing that the Fed can finish tightening and pivot to bailout fast enough to prevent wholesale meltdown.

Even at this late juncture I have yet to hear ONE pundit inform the public that a 2.5% Fed Funds rate is not enough to prevent economic depression, much less deep recession.

Yield curve inversion is now the flattest in forty years, meaning that long-term rates are significantly lower than short-term rates as the bond market predicts the Fed is making a COLOSSAL mistake by overtightening:

So it is that investors now believe that all bad news is good news for stocks. Their new buying mantra. A mantra that has been assiduously cultivated during the era of financial Disneyland that has abided since 2008.

Today's CPI showed that inflation may well be peaking, however some context is in order, because the CPI is still a long way from where the Fed will stop raising interest rates. If the past twenty years is any guide, that level comes in at about 4.5% on the CPI:

Deja vu of the March rally, this latest rally is an overthrow of the June high and a backtest of the 200 dma, coming off of the lowest volatility of 2022. In addition, VIX below 20 attracts a lot of bulls who believe it's a sign the bear market is over. It was a bull trap in April but for these amnesiacs that is long forgotten.

Here we see via AAII positioning data, the shocking divergence in cash balances from 2008 versus now:

https://www.aaii.com/assetallocationsurvey

In summary, it's abundantly clear that today's investors missed the "pivot" from inflation to deflation and from fantasy to reality.

And who can we thank for that but all of the pundits who told them that inflation was NOT transitory in 2022.

Wrong again. This time with no cash buffer AND no monetary safety net.