"Whipsawing commodity prices and eye-watering margin calls are forcing traders to reduce their activity, driving liquidity out of markets and exacerbating price swings, according to some of the world's biggest trading houses."

Thursday, March 24, 2022

The New Permanent Plateau Of Delusion

"Whipsawing commodity prices and eye-watering margin calls are forcing traders to reduce their activity, driving liquidity out of markets and exacerbating price swings, according to some of the world's biggest trading houses."

Wednesday, March 23, 2022

Front-Running Collapse

History will say the Ukraine war hid the collapse of the global economy behind an end-of-cycle commodity shock. Wall Street now has their excuse to run the herd over the cliff with the Fed now tightening into depression. With their only question being...

"What stocks should I buy in a nuclear depression?"

"WASHINGTON — Senators reacted with alarm to a new report that suggested Russian President Vladimir Putin could deploy a small, targeted nuclear bomb as his troops get bogged down in a costly, drawn-out battle against defiant Ukrainian fighters"

Where to begin...

First off, I will discuss the "nuclear" economic option of a Russian oil embargo:

A commodity spike at the end of the cycle is ultimately deflationary, because it's yet another shock to an already tapped out consumer. First consumers endured all of the pandemic-related supply chain shocks for the past two years, next they endured interest rate shock for the past six months, now we're having commodity shock. There is only so much pain consumers can take, which is why recession odds are sky-rocketing. When people see high prices they view it as inflationary, because they assume these prices will stay high forever. However, the definition of "inflation" is not prices that spike and collapse. When oil spikes, it means less purchasing power for other parts of the economy.

The West's Russian oil embargo drove oil prices to a manic peak two weeks ago. However, that "embargo" turned out to be a soft embargo, because most of Russia's oil is still expected to reach the market whether through Europe, India, or China. Which is why many speculators got dumped when commodities crashed -27% into bear market. Now commodities are making a second lower high.

In addition, we can see that crude oil demand in the U.S. is beginning to roll over in line with collapsing consumer sentiment. The hyperinflationary depression fantasy propagated by Putin and Zerohedge, is running on glue fumes.

aka. "Pravda"

Nevertheless, all of today's pundits are ignoring the bond market and yield curve inversion. The stagflation hypothesis is consensus. Even the Fed believes it now.

Which is why a hard landing is becoming far more likely:

The Fed is collapsing the global bond market, but they are not concerned because investors are still in RISK ON mode and hence collapsing risk premiums. Which is why market duress is not showing up in any of the Fed's key indicators. That lack of market stress ironically makes further rate hikes and further market collapse likely. Investors are in what I call a "Moral Hazard" death spiral. They are front-running the Fed into collapsing markets on the basis that the Fed will bail them out.

Meanwhile, the Fed is using their positioning as a rationale for tightening liquidity:

March 23rd, 2022:

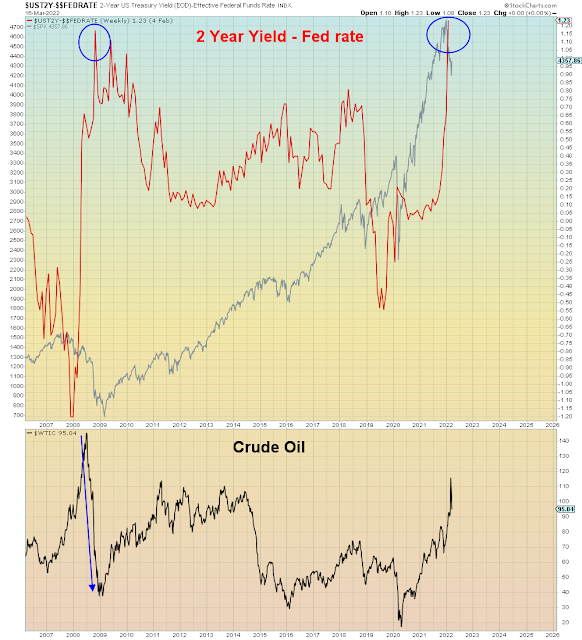

If the Fed raises rates .5% in May this year, it would be the first double rate hike since May 2000. Back then the Fed kept raising rates until the DotCom era Nasdaq was collapsed -80% and the economy was in recession.

Looking at the chart above, it's hard to believe the Fed will get that opportunity, this time around. The market is way ahead of them on rate hikes as we see below with the two year now above the Lehman level of 2 year minus Fed rate:

Which gets us to the casino:

Three waves are now becoming visible on the S&P 500. Confirmation is provided by NYSE new lows and the breadth oscillator.

This is a very weak retracement, but it's also a long retracement in terms of duration. When it started the S&P was two years oversold. And now it's two years overbought:

As one would expect, the Nasdaq is in far more dire condition. This wave count which is similar to the S&P's is extremely weak. And yet it's confirmed by the volume oscillator as a three wave correction. Normally wave 'b' above wave '1' and wave 'c' is above wave 'a'.

In summary, this decline and correction has been more about time than price. However, the next leg down should be more about price than time.

Gamblers who wait too long, are going to find out it's their bailout that gets delayed this time around.

Saturday, March 19, 2022

THE BIG LONG

In the age of scams, the burden of truth is on the truth. The bull case at this latent juncture is 100% fairy tale...

The only good news is that I can confirm for you that this lamestream Cirque Du Jerk is in no way prepared for what is coming.

What we witnessed this week will soon be known as the biggest policy error in human history. And who can we thank for that but all of today's bulltards who are convinced that inflation is as bad as 1979. For some reason these people can remember 40 years ago better than they can remember 14 years ago. Why? Because they've assiduously blocked that event from their minds. They forget that commodities were hyper bid in the early Fall of 2008 when Lehman was the last banking domino to implode. They forget that the Fed was preoccupied by inflation.

And they forget that by the time the Fed got around to a full and proper bailout it was too late.

This time last year featured a Tech stock melt-up coming out of the pandemic. It was the deflation trade driven to record extremes by the belief that work-from-home cloud technologies were in the early part of the growth cycle. Deja vu of Y2K when the millennial date change accelerated the expenditure on new technology, the same thing happened during the pandemic. Pull forward of Technology expenditure, featuring the biggest IPO/SPAC pump and dump in world history. By all rights Cathie Wood should have her own miniseries on fraud by now. But instead she is a regular feature on CNBC, the longest running documentary on excess greed in world history.

It was a year ago that the Gamestop pump and dump scheme democratized fraud:

Fast forward one year and instead of the deflation trade scam, we now have the reflation trade scam. Deja vu of 2008, the Fed has now been convinced via commodity Ponzi reflation that inflation is the greatest threat to the economy. What I call the "Stimulus Ponzi cycle": The Fed is chasing their own tail. They inflate markets, they create inflation, and then they pop their own bubble and create deflation. Today's so-called "experts" trust the Fed's ability to create inflation, but they totally ignore the deflationary policy taking place RIGHT NOW.

Coincidence or conflict of interest? You be the judge.

And that is halfway through the month.

Clearly we will see volumes that far exceed today's record level and I predict there will be a long red wick on that nascent reversal of fortune.

This week Tech stocks had their best week since the March 2020 lows. What happened is that hedge funds were force delevered when their record long commodity position exploded into bear market. In the event they were forced to "degross" and therefore buy back their consensus Tech stock short position. Which was widely conflated as a new Tech bull market.

Suffice to say, this is the most deflationary set of circumstances we've seen in two years. Last year was the best shot at inflation due to maximum stimulus combined with the vaccine rollout and global economic re-opening. And yet even then we see that the 30 year peaked in March and imploded lower. This current set-up by comparison will see a MUCH faster collapse in bond yields and return to uncontrolled deflation.

However the scam-riddled stock market is getting bought with both hands under the ubiquitous belief that the pandemic strengthened the global economy.

But really, who to believe? The bond market, or every dunce you know?

The SEC:

Thursday, March 17, 2022

All Signs Point To Crash

Back in 2008 the Fed made the exact same mistake they are making right now - believing that inflation is a higher risk than incipient global meltdown. In that event, the bailout worked. This time will be the hardest landing...

Over on Zerohedge, they have successfully "pivoted" from hyper-inflation last Fall, to stagflation last week, to recession now. Ironically, these are the same people who were mocking the Fed last Fall for saying inflation is transitory. And now the Fed is more hawkish than they are. It's this cabal of Peter Schiff acolytes who have assured this gong show will end as painfully as possible. The ubiquitous delusion is that the Fed can easily pivot back to cutting rates again.

There's only one problem with that fantasy: the Fed funds rate is at .25%, whereas in 2008 it was at 5.25%. There is nowhere to go on the downside. Therein lies the difference between this blog and all others - I don't assume there will be another happy ending when this end of cycle con job explodes. For that assumption you can go anywhere else where the sole objective is expanding the subscriber base and/or assets under management.

In 2008, in addition to a U.S. 5.25% interest rate reduction (i.e. 21 serial rate cuts), China's economy was still booming. It was China that dragged the world out of recession. This time they are leading the world into recession.

What you notice about this chart is that commodities follow China GDP, not the other way around. There is a staggering difference between China GDP in 2008 versus now. That was their highest growth rate in modern history.

All of which means that QE alone will not be enough to revive the global economy. What will be required is a combined fiscal + monetary super stimulus similar to what took place during the pandemic. Which will be challenging with a gridlocked Congress in a mid-term election year. When all else fails, I assume they will get it done, however, it won't be nearly as easy as during the pandemic.

And then there will be the protests and rioting. Why? Because a generation of Millennials is about to get financially wiped off the map. When that happens, one can assume that a TARP style bank bailout will be off the table. Which means that financials will be bidless. All of which means that the "just in time" bailout hypothesis which is propagated by all of Wall Street and most financial pundits, is lethal bullshit.

Go figure that Wall Street would not predict the wholesale collapse of their own industry.

Those who are not positioned ahead of time for what is coming will suffer TERMINAL losses. Why? Because there will be systemic meltdown of financial markets. Featuring extreme volatility. record volumes, and total lack of liquidity. Culminating in mass panic.

Unfortunately, the ubiquitous "hyper-inflation" hysteria has caused most investors to be very badly positioned for this impending event. Instead of respecting cash balances, they've been told that "cash is trash". What happened to hedge funds in commodities this past week is a warning for what's coming to the rest of the market. Going into last week, hedge funds were record LONG commodities. Then came the melt-up in crude oil last week followed by a straight line -30% crash into bear market. RECORD volatility, exceeding 2020. In addition, the nickel market has been shut down for over a week due to volatility.

These commodity trades are MASSIVELY crowded death traps at this phase of the cycle. Anyone can easily see that the commodity cycle peaked in 2008 along with China GDP above, and is now three wave corrective to a lower high. The pandemic commodity rally was an echo bubble.

But really who knew that a global pandemic and two year lockdown wouldn't lead to stronger global growth?

Not this Idiocracy.

Which gets us to the casino.

Bulls have mistaken post-FOMC volatility unwind for a positive response to Powell's rate hike. When these weekly puts expire or move further out of the money, options market makers buy back stock to unwind their option hedge. For the true direction we must wait until post-OPEX next week.

This market is now eerily similar to the last Fed policy error back in December 2018. Coming off the all time high, the market imploded -12% and then bounced up into the 50 dma. Then it re-tested and bounced up into a death cross. Which is where we are now. As we see, the % bullish is identical: This is the % of stocks that are deemed to be in a technical bull market. When the wheels came off the bus in late 2018 however, it was Trump who commanded Powell to pivot on rate hikes. Whereas this time, there is no chance Biden will interfere in monetary policy on behalf of stock gamblers. And Powell has already shown via the Nasdaq that he doesn't care if stocks implode. The Nasdaq is ALREADY down as much as it was when he pivoted in 2018 (not shown).

Here we see the extreme moral hazard that is now baked into this "market". In each of the past major market events, gamblers were reaching for hedges. However, in this event with global markets ALREADY in meltdown, there is no reach to hedge. In addition, this is the least likely time to get bailed out due to the Fed's hawkish stance.

This is beyond any level of risky risk-seeking we've ever seen:

In summary, I just nuked a bunch of trolls over on my Twitter feed. Bulls have command over the entire internet and yet they still feel the need to camp out on my site. My number of followers has increased dramatically recently, but I only care about quality not quantity. Today's bulls believe they have strength in numbers. Sadly, in an Idiocracy there is no such thing. Which is why the public is in no way prepared for this inevitable meltdown.

Wednesday, March 16, 2022

LIQUIDITY TRAP

We are at the brink of the fastest demand collapse in history. It's already beginning in Asia and Europe and will soon spread to the rest of the world. The Fed just reduced liquidity in an already illiquid market. Which gets us to the phase of global dislocation that I call "the Gong show"...

No, they don't see it coming. Read any pundit today and all they talk about is "stagflation". However, stagflation was a very rare occurrence that happened only in the late 1970s when the middle class was at its peak. It meant slow growth and inflation, but not recession. The critical assumption is that this Fed will allow inflation to persist when they've already taken steps to ensure that it does not. This Fed is actively pushing the economy into recession in order to squash wage inflation. That's all this is about. Everything else is just background noise. Why? Because the Fed ASSUMES they can manage a soft landing into recession. And that is the lethal assumption. They are pushing the economy towards a liquidity trap. Both in terms of market liquidity which has already collapsed and in terms of economic liquidity:

"A liquidity trap is a contradictory economic situation in which interest rates are very low and savings rates are high, rendering monetary policy ineffective"

From an economic standpoint, monetary policy is now officially ineffective. Yes the Fed can expand their balance sheet, but they won't be able to offset economic demand collapse. This is officially a larger policy error than what took place in September 2008, because back then the Fed had several percentage points of Fed rate to lower.

Bear in mind that the bond market has been warning of THIS risk all along. There was not one moment even during maximum fiscal and monetary stimulus where the bond market believed that inflation was a long-term threat. Pundits claim that at this same level of CPI the Fed rate should be at 13% as it was in 1980. Imagine if even the 10 year yield was at 8% which is 4x the current level. If that happened global asset markets would be a smoking crater right now. Comparing this period to 1980 is asinine, yet almost everyone is doing it right now.

As it is the bond market is already warning of recession after ONE rate hike:

This is the Five/Ten yield curve - most inverted since the 2007 recession began. But, the bond market is once again being ignored, by the Fed and all pundits.

The damage is done. The Fed is now ahead of the 2 year by the most since October 2008. What pundits and investors constantly ignore is the happy feedback loop between commodity speculation and inflation expectations. When both are rising they get locked in a death spiral higher. But when they are falling, they are in a death spiral lower.

Under these asset collapse conditions, "stagflation" is nothing more than a speed bump on a vertical path lower:

But it's not just the bond market that's being ignored right now.

China and Hong Kong are imploding in real-time. Not just their stock markets, their economies are imploding under the weight of the zero COVID policy.

The divergence in policy between the Fed and PBOC is now the widest since August 2015:

The elephant in the room is the impending default on Russian debt. The first default since 1998 and the first foreign denominated default in 100 years. As of this writing Russia hasn't made the payment due today. The last time Russia defaulted in 1998, the Fed cut rates .5%. Nasdaq lows reached this current level AFTER the default, whereas this is BEFORE:

Next, we learned yesterday that German economic sentiment just collapsed at the fastest pace on record. Faster than during the pandemic. You will note that European stocks are three wave corrective, having rallied for the past week. Given that record outflows from European stocks combined with record collapse in investor sentiment, then we can assume Europe is the next market to go fully bidless now that short-covering is ending:

Not to be left out, the Fed is also ignoring U.S. Tech collapse which this week was on par with December 2018 which is when Powell capitulated and reversed policy. As anyone can ascertain, not only has Powell not capitulated, but speculators haven't capitulated either.

What today's investors don't realize is that the Fed isn't worried about stocks imploding, they are worried about wage inflation. Therefore, they will continue tightening UNTIL they are convinced that wages are no longer a problem.

And that is going to take a while.

In summary, at the beginning this fraudulent market was running on maximum monetary stimulus - the virtual simulation of prosperity. Then it transitioned to running on maximum greed and Wall Street criminality. Having exhausted both of those sources of funds, it's now running solely on rampant self-destructing buffoonery at the end of the weakest recovery in U.S. history.