Thursday, November 5, 2020

Who Won This Election?

Now For The Real Crash

"America’s economy faces severe new strains in the two months between Tuesday’s election and January...millions of Americans are at risk of having their power and water shut off with unpaid utility bills coming due, while protections for renters, student borrowers and jobless Americans will expire by the end of the year absent federal action."

FOMC: Fear Of Missing Crash

Gamblers are racing back into the imploding Tech bubble to seek shelter from the collapsing economy. It's all monetary heroin and Go Daddy now...

Election day featured the second best election rally in history and yesterday was the best post-election rally in history. All despite still having no confirmed leader. Clearly we are on to something good. If they stopped counting ballots and declared no winner, the Dow would instantly double. We could have a pet squirrel for president.

On the monthly view, since September there was a Trump tax cut rally, a Biden stimulus rally, and this is the no leader, no stimulus rally. Each rally has become more manic and more vertical. What took 10 days to achieve in October, just took 5 days now. All it took was the absence of a leader and no hope of stimulus. The old age home has watched this movie three times now, and they still don't remember how it ends.

This is the largest rally since the wheels came off the bus in March. The week that also featured the primaries, a Fed meeting, and a jobs report.

Recall that the month of October was the Biden blue wave reflation rally. The idea that a unified government would bring to bear massive stimulus. Now however stocks are rallying because the risks of having a strong economy are now receding.

If you don't understand all this, you don't get Disney markets. It's called buy first, make shit up later. And always prefer monetary heroin over a good economy.

What all three rallies have in common is fear of missing crash. FOMC. What happens when the largest cap Tech stocks are moon shot into the stratosphere? We found out back at the February 2018 VixPlosion melt-up - they return from orbit bidless. Nevertheless, it's highly appropriate that the MAGA caps are leading this last stage glue sniffing rally. Notably however, only Google is at new highs. Amazon, Microsoft, and Apple are well below their September peaks.

Outside of MAGA caps, semiconductors are leading the overall Tech blowoff top:

So far, the wave count remains intact.

Brick shitting panic is on tap when everyone gets loaded up with risk for the end of year Santa rally.

One can make the case that the next geezer for president is already priced in. Markets apparently got what they want, another stimulus stalemate between Pelosi and McConnell.

And a new record pandemic case load.

In summary, the algos are running flat out to get as many bulls onboard as possible. Before they hit the exits and leave the bulltards in a bidless market. Because after all, someone has to be left holding the bag. It's tradition.

Just remember, "No one saw it coming"

Again.

Wednesday, November 4, 2020

MAGA Is Running On Glue Fumes

NO LEADERSHIP

Monday, November 2, 2020

Epic Clusterfuck: Base Case Scenario

All of the pundits are out war gaming the election scenarios and market outcomes, so I have to do my part. The biggest risk markets face is the fact that if Circus Donny doesn't get his way, he is going to have a biblical temper tantrum...

Soon we will know whether or not human history's largest pump and dump will continue. Or explode.

First off, we know that with less than two months to go Wall Street is leaning hard into the end of the year. They can't afford another SNAFU like 2016 when Trump won and the market exploded higher to everyone's surprise. Which is why CNBS all star bulltards such as Tommy Lee are saying that every election scenario, including a contested election will bring a happy ending for gamblers. This guy should have never quit his day job as drummer for Motley Crue. Nevertheless, he predicts a blue wave as his base case scenario, so let's start with that possibility.

He admits that under a blue wave scenario the Democrats are going to come out swinging against the mega cap Tech cartel. So take the largest sector off the table. He neglects to mention that Democrats are also going to monkey hammer Wall Street back to Dodd-Frank land. So take the second largest sector, Financials, off the table. Then they will go after the healthcare cartel, so take the third largest sector off the table. After that they will put taxes back to where they should have been this entire time. What the barely recognizable drummer from Motley Crue turned investment guru forgets is that before any of the aforementioned takes place, Big Donny is going to have a big hissy fit and pass nothing until inauguration. Leaving the cyclical trade also bidless.

That's the best case scenario.

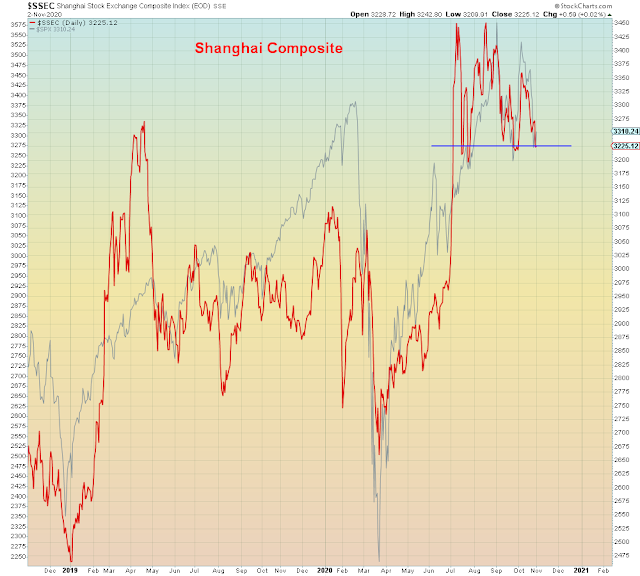

The second scenario he posits is a Trump win. For some reason, Lee doesn't consider who wins the Senate. He fantasizes an even bigger rally than the blue wave, so we have to assume a red Senate, meaning the exact same gridlock we've enjoyed for months now. First off, what no one expects is that China will implode if Trump wins. The top performing stock market of 2020 will get monkey hammered one day ahead of the largest IPO in history.

Meanwhile, the stimulus impasse that has continued non-stop since stimulus lapsed at the end of July will continue. McConnell has already said there will be no stimulus until 2021 at the earliest. A Trump win will only encourage him to continue his overarching goal to implode blue states. In that scenario, bond yields collapse, the muni bond market explodes, and the cyclical trade goes bidless.

The scenario that Tom Lee omits is a Biden win with a red Senate under McConnell. In that scenario, stimulus impasse deepens and Trump throws a bitch fit until inauguration. Not pretty.

Last but not least is the wholesale clusterfuck that I expect. A contested election that drags on for weeks. Tom Lee expects markets to defy the Y2K analog and rally, albeit on a muted basis. One would have to be smoking crack to believe this guy, which is why he is the go to guy on CNBS.

If we look to one chart that sets the table for Tuesday, it would be this one of the almighty Dow.

The Shanghai Comp is standing by to get monkey hammered by an unhinged nut job and history's most leveraged IPO:

“This is huge: the largest IPO ever, priced at the top end and now this huge premium in the gray market,”

“It’s pretty extraordinary given the backdrop and it shows you how much Asia is decoupling from the United States.”

What could go wrong?

The virtual economy is at the precipice

In summary, we are about to find out whether or not four years of incessant bullshit is about to turn back into a pumpkin.

The Global Dow peaked in early 2018, almost three years ago, when the rest of the world decided they had seen enough greatness to know that it should never get re-elected.