Thursday, October 1, 2020

Human History's Biggest Margin Call

Wednesday, September 30, 2020

October 2020 In Trump Casino

The economy is imploded, but gambling is alive and well in Trump Casino. It was the first down month since March, which means it was another victory for the bulls...

First, let's recap September in Trump Casino:

Late August ended with a massive melt-up compliments of the Republican National Convention. The casino peaked on Wednesday September 2nd. Then it imploded into end of week options expiration. Then it rallied into FOMC Wednesday Sept. 16th and imploded AGAIN into weekly opex. Then it rallied into the end of the month to nicely paint the tape at the end of the third quarter. By total coincidence similar to August. It was the first down month since March, yet volatility peaked at the beginning of the month, as gamblers bought the dip with both hands.

The Nasdaq went nowhere for the past three weeks as breadth imploded:

Gamblers kept Momentum Tech well bid, continuing to use options to manipulate the market:

Weak bears capitulated. A necessary and sufficient condition for a crash:

Chinese stocks imploded deja vu of February/March:

Solar stocks went late stage parabolic, as the ESG movement picked up steam amid widespread fossil fuel divestment.

The IPO pump and dump accelerated into month end, as economic cyclicals imploded

Safe havens pre-imploded

So, let's compare today's market relative to the 2018 mid-term elections:

Back then, the casino peaked in late September and then fell the entire month of October leading up to the election.

This time, the casino peaked in early September, putting it at a weaker position going into October.

What could go wrong?

Reaching The Minsky Moment In Trump Casino

"Since the 2008 global financial crisis, American corporations have taken advantage of historically low interest rates to gorge themselves on debt. Then came the pandemic and the sharpest economic downturn in history, which resulted in an odd solution for the companies that did all that borrowing: more debt"

Tuesday, September 29, 2020

The New Permanent Plateau of Delusion

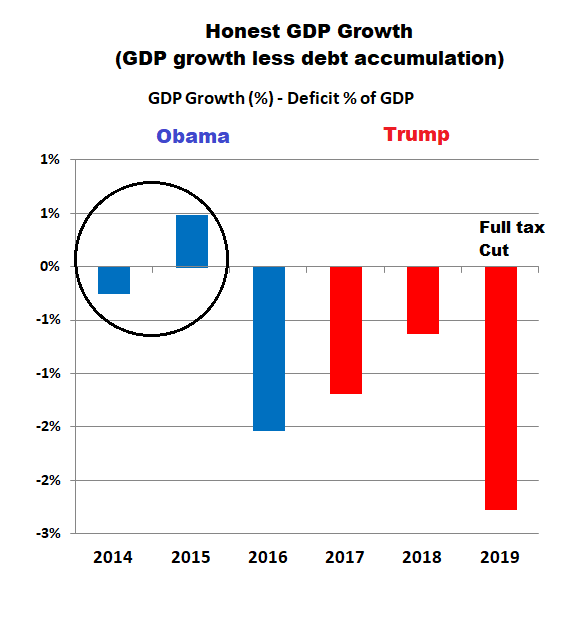

This is the largest misallocation of capital in human history...

I mean easy money:

This podcast/article, below, gives a good summation of the perverse incentives driving money managers to overdose on ludicrously overvalued Tech stocks. I would first point out that it's not their money. I don't normally listen to podcasts, but I found this one quite interesting, as it touches on topics ranging from asset bubbles to economic ideology. It kicks off noting that all risk asset markets have converged upon an identical left to right upward slope. Meaning they are massively correlated. Including so-called safe havens such as gold. Then it asks the critical question, what would it take for the Tech/deflation bubble to implode. Somehow never once wondering if it's imploding right now. Then, the usual historically illiterate question, how long will it take for the economy to float back from China? At which point the discussion segues into the philosophical question as to whether or not today's monetary assisted robber barons have perverse incentive to keep the central bank spigot attached to their Cayman Island bank accounts permanently.

My answer: Only until the riots get out of hand.

"These days it seems like all financial markets are the same big trade. A gold chart looks like a Tesla chart, which looks like an Ethereum chart, which looks like a chart of a basket of cloud computing stocks. So why is this? And what could cause that to change? "

Indeed. Let's contemplate this question:

One hypothesis floating around Zerohedge is that investors are TOO bearish ahead of the election, which is putting a floor beneath the casino. Every selloff is met with short-covering or options monetization, the derivative version of short-covering.

I would agree that high amounts of bearishness among institutional investors has kept this gong show going longer than expected. Because other than short covering, there is literally no bullish case for owning stocks right now other than to pray that an even bigger dunce will come along later. A risky bet that many have made but no one has ever collected upon.

Fortunately, as stocks have now fully decoupled from reality, into this new permanent plateau of economic implosion, Wall Street will continue dumping multi-year record amounts of junk IPOs, until something explodes. Putting some amount of certainty back into this equation:

"At this point, only hermits without WiFi would be unaware that 2020 is the busiest year for IPOs since 2014"

Recall that late September 2014 was when the Alibaba IPO crashed the U.S. market. Now we are waiting for Alibaba's Fintech spinoff "Alipay" aka. Ant Financial will crash Asian markets any day now. In the meantime, Wall Street is front-running the global RISK ON party.

Among the stock market bubbles that have not yet imploded this time around, today Solar/Alternative Energy stocks went late stage parabolic:

Looking at out of the money crash bets, here we see that the September stair step lower has seen crash bets decline, as the weak bears got monetized.

It's called capitulation.

The large cap momentum trade is sporting a double a-b-c zig zag on the hourly. Both are Elliott Wave "flats" meaning that the origin for wave c is the same level as wave a, which is highly unusual and extremely weak.