This will be the biggest financial clusterfuck in human history...

Opportunistic psychopaths are exploiting useful idiots, in the American tradition. Morally challenged gamblers are about to learn the lesson of a lifetime...

mor·al haz·ard

"lack of incentive to guard against risk where one is protected from its consequences"

First, on the subject of the exploding mental health crisis. When record Americans believe that the country is heading in the wrong direction, how can anyone be truly happy? Is "happiness" even possible in times like these? It's an important question. Until now I have always been of the belief that we are all ultimately susceptible to darkening social mood, whether we realize it or not. Just the fact that we are constantly subconsciously reminded that everything is terminally fucked up, tends to weigh on the mind. Today's consumption Borg of course finds their own virtual simulation of happiness from the innumerable corporate addictions on offer. All of which are chased down with ever-larger dosages of pharmaceuticals to paper over the chasmic cracks in reality.

Personally, in order to achieve inner peace, I have come to the rationalization that all of this upheaval was a necessary precursor to reaching a better future. In the same way that soil must be tilled before a garden is planted, the failed past and the attendant mythology must be fully imploded in order to make way for a more sustainable future. Whether or not that is sheer fantasy doesn't really matter. Human beings live in a perpetual state of self-delusion, And therefore we are given to attributing reason to explain current events, when in fact it may be above our spiritual pay grade to understand. In addition, I have decided that at this point in my life the inner journey is more important than outside ambition. Especially in a world wherein any form of material ambition could very well lead to over-investment in collapse. In the end, we will be far more rewarded for who we are, than what we are. Nevertheless, this society is so well trained to maintain superficial appearance that no one told them they are now nothing more than useful idiots. Clowns in a circus. The fact that we are currently led by a morally void charlatan who constantly claims success when there is only failure, does not bode well for their future.

In summary, we are lied to constantly by desperate psychopaths. And nowhere is that more true than in the chasmic gap between financial markets and the economy.

We must always remember that the vast majority of investors, pundits, and advisors are ALWAYS net long financial risk.

Which is what makes this moment so lethal. By pushing interest rates down to record lows, central banks have forced all of today's participants to fully embrace Ponzi finance. Throwing good money after bad. Worse yet, the COVID virus is now being used as an excuse to explain away the end of the cycle. In other words, the deterioration in financial solvency is being blamed solely on the "transient" virus. Which is how they arrive at their "v-shaped" recovery.

We are in a bear market at the end of the cycle, at the very beginning of an economic crisis of unknown dimension. Central banks are maxed out from an economic perspective. All they can do now is create a larger divergence between financial assets and reality. And in that sense they have succeeded beyond all expectation.

Here we see an example of yield seeking amid the worst corporate defaults since 2008. Global gamblers are now viewing rising default premium as a buying opportunity.

In 2020 so far, the "smart money" has been looking pretty dumb this year. For the most part these people are merely trend followers - conditioned by over a decade of central bank funded asset Ponzi.

Here we see that active managers sold at the bottom in March and have reloaded again at the top of the rally. They were wrong at the top in February, and they are wrong again now.

They are trend-following chimps:

For their part, the dumb money, meaning Robinhood gamblers, wisely stayed on the sidelines until the COVID crash but then they rushed into cyclical stocks to be the official bagholders of record.

The top five largest holdings (by number of account holders) on Robinhood are ALL cyclical stocks (as of this writing): Ford, GE, American Airlines, Disney, and Delta Airlines. These stocks all have roughly the same chart as indicated below via the airline index - three wave corrective off of a dead cat bounce. It's clear that these neophyte investors have all bought into the v-shaped recovery 100%.

"Near-term bookings at United's hub in Newark were only 16% of 2019 bookings as of July 1"

On a longer time frame we see Ford below, which is the number one holding on Robinhood. Unfortunately, as it was in 2008, these people STILL don't know a traditional retail bagholder when they are looking at one in the mirror.

Where it gets interesting of course is on the Nasdaq Tech bubble - the U.S. Nasdaq is the ONLY global index that is not yet in a bear market. The only global index making new all time highs.

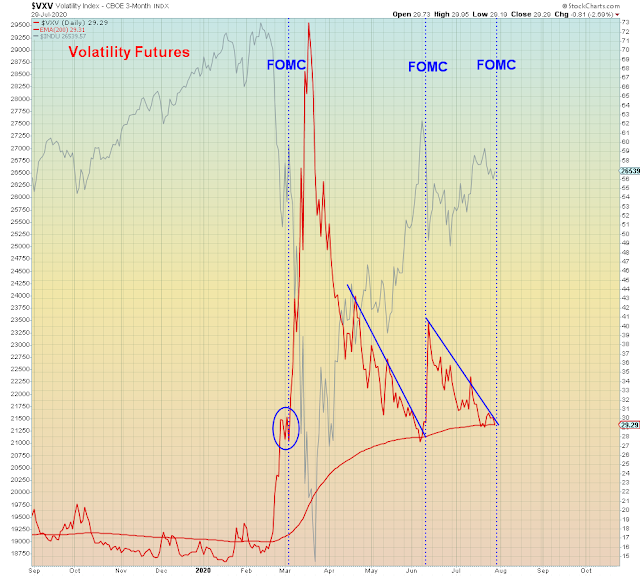

Be that as it may, below we see on a longer-term chart the massive divergence between the stock index and the Nasdaq volatility index.

We have NEVER seen this before. What does it mean? It means that hedging is very expensive and therefore the largest and most over-owned stocks in WORLD history, are now largely unhedged.

In summary, the noose has never been tighter.

The beauty about watching U.S. news is that you never have to worry about what is going on in the rest of the world.