There is no sign of economic reflation, however faith in central banks is now complete. The Fed pumps up asset markets, and rampant bullshit artists explain how trickle down Ponzinomics can replace collapsing businesses and reduced jobless benefits.

Any questions?

“This is really a day that will live in infamy”

Any questions?

“This is really a day that will live in infamy”

Post FOMC, now we will find out if Disney markets will implode the same as last time (June 10th). Reflationists are having a blast bidding up their own shiny assets. However, they never stop to ask themselves why their gold "safe haven" is now 100% correlated to Go Daddy. Gold has become a dangerously crowded dumbfuck bubble, in the tradition of BitCasino. But don't take my word for it:

Revolutionary indeed.

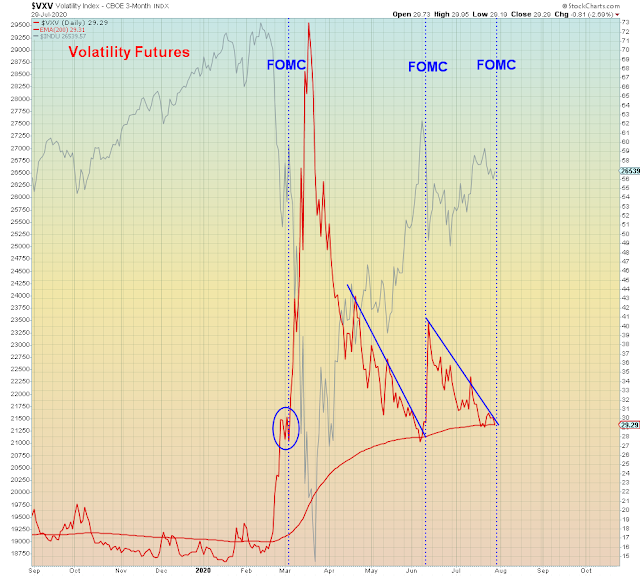

Getting past gold, here we see that volatility compression has been taking place deja vu of June.

Market manipulation has now become normalized and widely accepted.

No blow-off top would be complete without AMD going parabolic.

China Tech making three lower highs deja vu of February:

Everyone is betting that the dollar continues to "crash". I am betting it will crash too, in a risk off move that takes down global markets. And then it will scream higher taking out the shorts when everyone realizes that the rest of the world is more fucked up than the United States. Financially speaking of course.

Been there, done that.

In summary:

"But as the economic crisis wrought by the Coronavirus pandemic continues, some current and former financial regulators see the loosening of this regulation as potentially increasing risk in the financial system at a time when there is little room for big losses"

"But as the economic crisis wrought by the Coronavirus pandemic continues, some current and former financial regulators see the loosening of this regulation as potentially increasing risk in the financial system at a time when there is little room for big losses"