The Coronavirus has served its purpose of disguising nascent depression, as gamblers now believe this is a v-shaped buying opportunity. The super stimulus locks them in for the elevator ride lower. Gamblers are being told this is their last chance to get in, when it's very likely their last chance to get out.

What we are witnessing is natural selection at its finest...

Deja vu, I just posted what billionaire Paul Tudor Jones said about this week's thermonuclear stimulus package in my prior post about MMT.

This is what he was saying a few months ago before Mike Santoli claimed that "no one saw it coming":

November 2019:

“We’ve got an explosive combination of monetary and fiscal policy right now. We’ve got a 5% budget deficit coupled with the lowest real rates that you can image with the economy at full employment. That’s the most unorthodox, and potentially explosive, combination that you can imagine."

The Coronavirus rally culminated in late February 2020 long after the virus had spread worldwide. The ultimate explosion was the fastest and most devastating crash in U.S. history. Twice as fast as 1929.

Now, today, the Dow is enjoying a third day of gains (so far) based upon the worst jobless claims number in U.S. history without any comparison:

Despite these depressionary numbers, the belief in a v-shaped recovery is ubiquitous. The Coronavirus has led today's pundits to believe that the nascent depression is temporary:

"Speaking with NBC's "Today" program, Fed Chair Powell also said the U.S. economy likely already is in recession, but noted that activity could rebound in the second half of the year if the spread of the coronavirus is quickly brought under control."

Fifty years of weekly jobless claims:

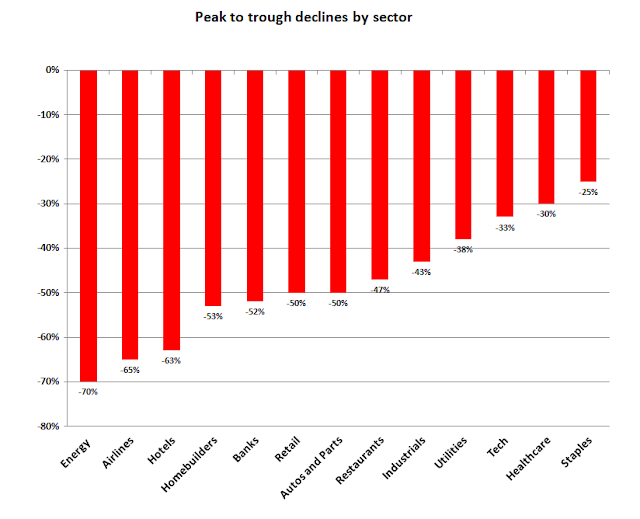

Here we see the % declines by market sector, which gives lie to any v-shaped recovery. The Energy sector was already reeling from over-capacity, the OPEC oil war, and of course the ESG divestment movement. Airlines just got pounded similar to 9/11 when many of them went bankrupt. The same will happen now. Hotels and hospitality are not coming back any time soon. No one is going to buy a new home in this environment. Banks are under-capitalized for this type of event AS ALWAYS. Auto loans were already going bad prior to this crisis. Retail closures were at a record prior to this crisis, this will put many of the remaining chains at risk. Industrials and global trade were already in recession from the trade war. What's holding up on a relative basis are recession stocks and the Tech bubble.

Today's jobless claims are very likely minor compared to what is coming. What we see above is the FIRST week of layoffs following Trump's shutdown of the economy.

Trump is now panicking to get the economy restarted and for once I agree with him. I get that some people are going to die. People die every day. McDonald's kills more people every hour than Coronavirus kills in a month.

What they should do is shut down McDonald's for six months and bring everything else back online. Save millions of lives. But of course these morons did the exact opposite - shut down real restaurants and kept McDonald's drive thru open:

If today's comfort seekers had ANY clue what is now at stake, they would not be considering this to be just an extended vacation. The people who are right now arguing to keep this shutdown going indefinitely are NOT the people who have been so far affected by this quarantine. They still have THEIR jobs. Nevertheless, they are the people who are next to get wiped out when they realize this is not a v shaped buying opportunity.

That's just my opinion. I could be wrong about this, but I doubt it. The economic impacts of this pandemonium will far outweigh the health impacts.

The one benefit of this super stimulus is that it will likely keep Trump Casino open a few weeks longer. Full disclosure I have no positions long or short in stocks. Nevertheless, here is an update on Trump Casino:

As of yesterday's mega rally, the S&P is now one month overbought. Today's rally will likely take it back to multi-month overbought:

We need to keep this mega stimulus rally in perspective relative to the technical damage inflicted by nine 90% down days in one month on MASSIVE volume.

While we're here, let's take another look at Tech, prime beneficiary of BTFD:

"For the most part the secular growth theme has held up well since the S&P 500 index SPX, 3.803% peaked on Feb. 19, unlike the second half of 2018, when recession fears caused equity investors to briefly abandon this theme"

In other words, professional gamblers were more concerned about recession in 2018 than they are today. Why? Because in 2018 the Fed dopium was tightening while today it's at level '11' maximum.

In summary, gamblers have been told to ride out the depression, and that's what they plan to do: