This week is COP 27, which happens to mark the 30th year of UN climate conferences leading to absolutely nowhere. Which is more cynical, to not believe in man made environmental disaster, or to believe that pretending to care will fix the problem? This climate charade is just another warning for a society in latent death spiral, with not even the slightest will or ability to change its ways. The pandemic was the best test for climate activism we will ever get - because it caused the largest carbon collapse in world history. No flights to anywhere. No commuting. A virtual economy. The price of crude oil went NEGATIVE for the first time in history. Green energy/EV investment sky-rocketed. Fossil fuels were divested. At the apex of the bubble, Tesla had a larger market cap than the S&P Energy sector.

However, upon exiting the pandemic we now learn that all of the predictions for climate apocalypse have been moved up in time from 50 years to next week. More drought, more wildfires, more mega hurricanes, and more empty lakes and rivers.

In other words, it's far too late to pretend to rearrange the deck chairs on the Titanic. What we don't know, is whether or not global economic collapse will "fix" climate change after the fact.

But fortunately we are about to find out...

Who says I'm not an optimist?

Now back to the Casino where all manner of economic risks are likewise being ignored:

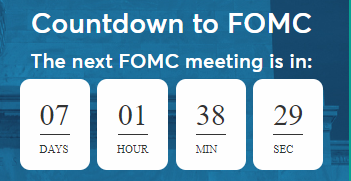

As we approach the end of the year, investor cries for a pivot keep growing louder. Zerohedge has been predicting imminent pivot for months. Now Cramer is on the pivot bandwagon as well. Recall, it was only a few months ago that ALL pundits were pounding the table that inflation is NOT transitory and the Fed was far behind the curve. It turns out the Fed actually believed them and they are now in full Volcker mode, meaning "keeping at it", as Volcker did for two years straight.

“Pausing (Pivot) is off the table right now. It’s not even part of the discussion”

What it comes down to is the fact that today's pundits are following the POST-2008 playbook, whereas the Fed is following the PRE-2008 playbook. Meaning the Fed won't pivot UNTIL investors panic. And ironically, Team Pivot is preventing them from doing so. All of which is a tale of extreme moral hazard. Gamblers were bailed out for fourteen years straight during economic expansion and bull market. Now, when the economy is imploding, there is no bailout forthcoming.

Which is why bulls are doomed to explode.

The primary assumption bullish pundits are making is that Tech stocks will resume their bull market when the deflation trade returns. However, below the Y2K experience shows the Fed pivot effect was very short-lived.

Nevertheless, today's investors are eagerly waiting for the melt-up to begin.

The other major assumption that today's bullish forecasters are making is that there will be NO deleveraging caused by Fed tightening. And yet we also see above that in 2007 the Fed pivot preceded the housing bubble implosion.

Which makes yesterday's headline very timely. The largest jump in household debt since 2008:

In other words, despite massive interest rate increases, household debt is STILL increasing. Which means that as the various bubbles collapse, households will be stuck with massively inflated liabilities. Which, will be highly deflationary.

In summary, the recent collapse of the FTX Crypto Ponzi scheme was merely a warning for what is coming. The CEO claims he had no idea how much leverage had accumulated in customer accounts. So far, there have been NO arrests. Why? Because what used to be considered corruption is now merely accepted as fraud-as-usual. Over the course of the past several decades, this society has systematically de-regulated criminality.

The same can be said for the global economy - central banks have no clue how much leverage exists in all of its derivative forms. However, they are going to tighten until we find out who has been misallocating free capital. Or as Warren Buffett says:

"When the tide goes out, we discover who has been swimming naked".

And when that happens, trapped bulls who ignored a decade of warnings are going to need a time machine.

To go back to when they still had a chance to change their ways.

Before it was way too late.