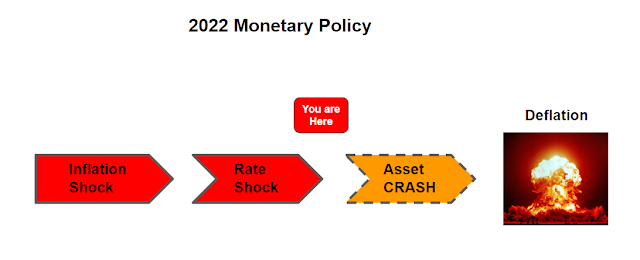

"What is becoming more apparent, however, is that it will be difficult for the U.S. — and other major economies — to wean themselves off the extraordinary support the Fed has given it in the past 15 years"

“Their own policies created the fragility, their own policies created the dislocations and now we’re relying on their policies to address the dislocations”.

Good luck.

After 2008, Zerohedge emerged as the leading critic of centrally managed markets. That skeptical view lasted all the way until the pandemic when whey emerged post-pandemic as newly converted believers in monetary bailouts. It was their chance to shed their perma-bearish image and join Wall Street in propagating the myth of perpetual market manipulation. So it is their fate that stocks are now having the worst year in 50 years. That sort of late stage "pivot" is called capitulation. What you would expect at the END of a bull market.

Now in 2022 JP Morgan's markets "guru" Marko Kolanovic has been bullish all year. However, this past week he turned bearish and admitted that his assumption central banks would NOT make a massive policy error in 2022 was wrong. Central banks just made a massive policy error in 2021, so in 2022 he believed they were going to get it just right. You have to be an Ivy League PhD to believe that moronic delusion. What we are witnessing is BULLISH capitulation.

Also capitulating, the aptly named BEAR Traps Report, now expects a Fed pivot by November.

"In the coming 2-4 weeks, we expect a meaningful walk-back from Powell with a focus on financial stability"

Likewise, here is what the most bearish Wall Street pundit Michael Hartnett said this past week - Markets are breaking so get ready to buy stocks:

"Spiraling losses on Wall Street are now snowballing into forced asset liquidation, according to Bank of America Corp. strategists"

BofA strategists said to “bite” into the S&P 500 at the 3,300 level -- about a 9% decline from the latest close, “nibble” at 3,600 and “gorge” at 3,000. Hartnett and his team added that a drop of 20% below 200-day moving average has been a good entry point back into stocks in the past 100 years."

In other words, Wall Street pundits are converging on a NEW CONSENSUS view - MINOR additional downside followed by a seamless bailout.

It's a similar consensus from the one this past summer, but the stakes have been raised in the meantime. It indicates there has not been any TRUE capitulation, because these new pivot believers are once again positioning investors AHEAD of the pivot.

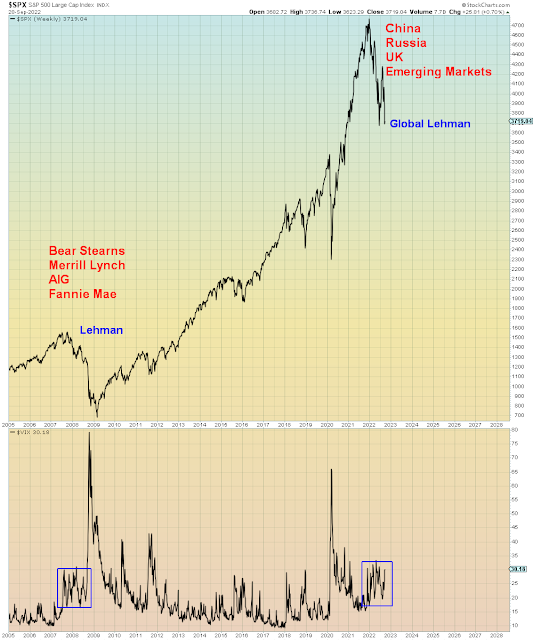

Barron's ran an article over the weekend which spells out the Russian Roulette investors are now playing. A Fed put that is now far below the market:

Front-running the Fed is a very dangerous game to play right now. Why? Because the assumption investors are making is that the Fed can engineer a controlled explosion and then bailout markets with limited dislocation. What these people didn't learn is that in March 2020 the Fed required $2.5 trillion of IMMEDIATE QE to get the market under control. Yes you read that right.

Confounding this new bailout delusion is the fact that the Fed themselves are not nearly as worried as investors desperately NEED them to be:

September 27th, 2022:

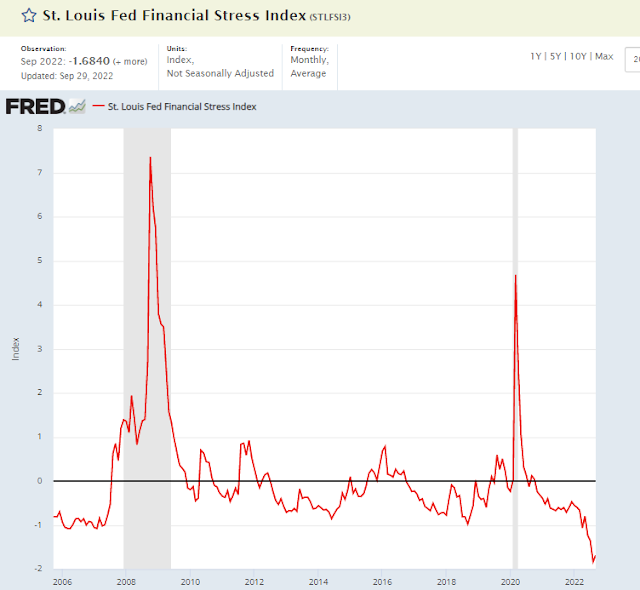

The Fed's own financial stress index remains NEGATIVE:

What we have right now is make-believe capitulation.

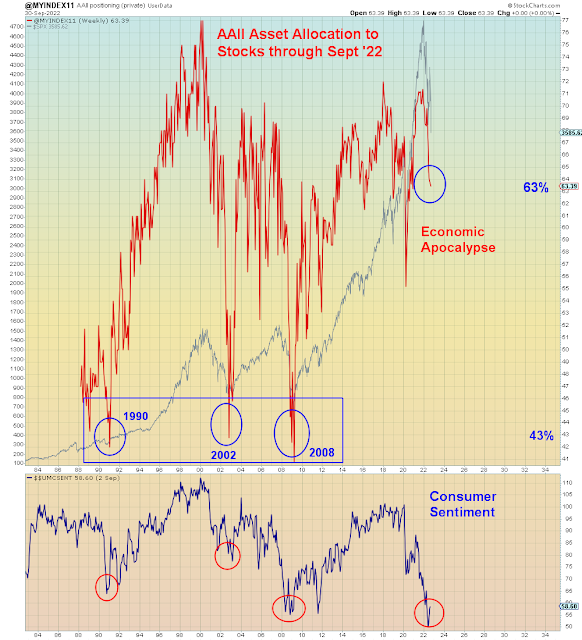

The AAII (Retail investor) positioning update for September indicates there is still a high degree of stock ownership:

https://www.aaii.com/assetallocationsurvey

In summary, the Fed and investors are now dead-locked. Each side expects the other side to capitulate. Neither side is backing down, which means the Fed will continue to ratchet up the pressure. At this late juncture, investor capitulation has been delayed to the point that the systems won't be able to handle a global RISK OFF event. The inflation-trade has seen massive flows from bonds to stocks during 2022. A reverse flow from stocks back to bonds will break the market in such a way that the Fed will NOT be able to put humpty dumpty together again.

What bailout follows will be solely dependent upon the political regime that exists at the time. Which right now is the most polarized in modern U.S. history. Only a fool believes there will be a Congressional bailout in 2022.

Last week, Corporate bonds saw their biggest liquidation since March 2020. However, the *special* bailout powers that were granted to the Fed during the pandemic were rescinded in 2020.

Which means the deleveraging event that Wall Street never sees coming is ALREADY underway.

When the masses finally panic out of the totally unhinged market, you can rent stocks, but you can't own them. The days of owning stocks for the "long term" are over. In the 1930s there were 10 bull markets and 10 bear markets, about one a year for a decade.