The Fed needs markets to capitulate to get to neutral, but markets are anticipating neutral so they never capitulate. In the meantime rates keep climbing...

The seeds of this disaster were planted over a decade ago when the Fed switched from interest rate based policy to balance sheet policy at the zero bound. Over the past 14 years they've been using financial markets to manipulate the economy, instead of the other way around.

It's totally asinine to believe that a 1.5% interest reduction during the pandemic caused a 9% inflation rate and yet that's exactly what the majority of pundits currently believe.

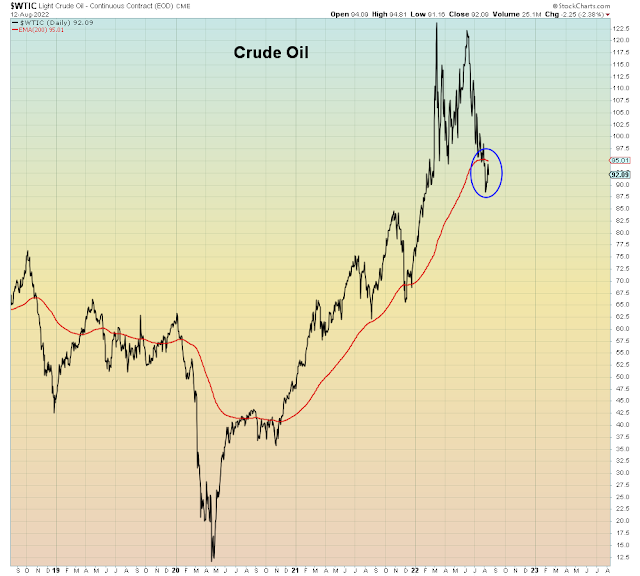

One year ago at Jackson Hole 2021, Powell made a mistake when he said that inflation was transitory. Back then everyone believed that inflation was caused solely due to the pandemic unemployment fiscal programs. A $300/week unemployment stipend was causing hyperinflation. You would have to be an idiot to believe that, therefore it was consensus view. Only one of the many dunce theories propagated by Zerohedge during the past year. Of course those fiscal programs ended a year ago, which is when inflation accelerated. So in 2022 the Fed hurriedly raised interest rates back to pre-pandemic levels. And here we are with inflation STILL near 9%. Why? Because the Fed balance sheet is too large and the wealth effect is still working its way into the economy via asset markets. The Fed's entire strategy for 14 years has been market based but still market participants think that interest rates control inflation and the economy. We are now in a trickle down fake wealth economy:

August 2022:

"Ferrari has reported record quarterly sales and profits as concerns over the global economy fail to dent the enthusiasm for buyers of luxury trophy vehicles.

The company, the latest luxury or supercar manufacturer to post record profits after Lamborghini and Bentley"

We've seen four consecutive rate hikes of increasingly shocking magnitude, the last two being .75%. Now ANOTHER .75% is back on the table, all because markets have been front-running the Fed again. Which was due to the mistake Powell made in July of this year stating the Fed rate was in the territory of neutral. Now this week, he has to back out of his mistake from last month and from the entire past year.

Which means he is going to club markets like a baby seal.

He is going to crush any hopes of a near-term pivot and in the process he is going to force RISK OFF. His credibility is at stake.

"The chair of the Federal Reserve may have a hard time convincing markets that the central bank is serious about defeating inflation. But he’ll have to try"

Powell must take care to disabuse markets of the notion that the Fed will soon be done tightening monetary policy"

What a lot of people forget is that even the mighty Volcker screwed up forty years ago. He raised rates initially and shocked markets, but then he quickly lowered rates. Which caused inflation to resume. Which is why he had two recessions, one in 1980 and another in 1982 when we was forced to shock markets a second time. Today's Fed members know all this about Volcker history which is why in this week's FOMC minutes there was a discussion around raising rates and keeping them elevated for an extended period of time. Which is the opposite of what stock market bulls expect.

"Some officials indicated that once rates had been raised to the point where they were cooling down the economy “sufficiently”, it would probably “be appropriate to maintain that level to ensure that inflation was firmly on a path back” to the Fed’s target of 2 per cent"

This week, Fed member Bullard reiterated that he sees the Fed rate at 4% this year. Sooner than later. Which would be almost DOUBLE the pre-pandemic interest rate.

Risk markets are now overbought going into the riskiest period of this year and this cycle. On the belief that bailout is imminent. When, nothing could be further from the truth.

This week the Nasdaq 100 reached the most overbought level in history based on MACD. Tied with August 2020 another low volume levitation period. MACD is a momentum indicator based upon the convergence and divergence of two moving averages - one short-term and one long-term. When MACD is high it means that the market is going parabolic and the short-term indicator is moving quickly relative to the long-term trend.

Hedge fund short covering is highly evident in this chart of active manager risk exposure:

In summary, soon all risk markets will be at new lows for the year. And the Fed will be doing nothing about it except waiting for bulls to finally capitulate.

And then when that happens and the machines abiding this low volume illusion go offline, EVERYONE is going to realize that the big mistake didn't start in 2022. It started when investors were systematically conditioned by the Fed to become bailout whores.

With the USD at the highest level in 20 years, the risk of a policy error has never been higher.

Consider that the Fed was cutting rates the last two times the dollar was sky-rocketing in a recession.

And to think, investors are front-running rate cuts in a recession. Which equals a long bear market.