In this market, when one fraud ends, another begins. Bulls have an insurmountable advantage in the war of words - not only do they have the full weight of deception on their side, but they have an audience of eager accomplices. Meanwhile, us critics of criminality are the enemies of all that's fun in manipulated markets, and hence perma-boring...

Sadly, as they will all learn the hard way, having your head up your own ass is not a Black Swan event.

There's a scene in the movie Sling Blade where the father (Robert Duvall) excoriates his son (Billy Bob Thornton) for killing the wife/mother for cheating on him. So the son kills the father too.

Here we are - there are no innocents left in these markets. There can be no defense from the supposed unpredictability of a "Black Swan" event as so many have done in previous selloffs.

This is Q1 in a nutshell:

Highest CPI in 40 years (which led to recession in 1980)

Largest oil shock in 50 years (which caused recession in 1973)

Largest global bond collapse on record

Fastest Fed tightening on record (which preceded EVERY recession)

War in Ukraine

And yet all bought with both hands. The ultimate example of moral hazard. Far too many bailouts have led the masses to run towards risk.

Which is why markets just made a round-trip of record deception. Institutions sold, while retail investors bought the dip with both hands:

Individual investors have purchased a net $39 billion of stocks since January, the largest at this point in at least five years"

Institutional selling at market tops has been a "feature" of every end of cycle bull market in history. And late stage retail bagholding has also been a "feature". It's called distribution - and it means large investors selling stocks to the masses.

If at the beginning of the year anyone told you those above risks would abide in three months, would anyone believe the "market" would still be near all time highs? Of course not. This is now entirely about misallocation of capital.

Deja vu of last year when the growth stock led deflation trade melted up and imploded spectacularly in Q1 - we just saw the exact same melt-up in the reflation trade, led of course by commodities. The war was the catalyst for the manic blow-off top, however the reflation rally had been gaining steam since the election, vaccine rollout, and global re-opening in late 2020.

Which is why for the first time in this entire rally since the March 2020 lows, BOTH the NYSE and Nasdaq are now overbought at the same time.

You will note that S&P breadth (top pane) made a large leap up in June 2020 which was accompanied by a record breadth thrust in the NYSE (mid pane). Now we see another surge. Also last year saw the manic melt-up in growth stocks, followed by this echo surge. Anyone can see however, that overall S&P breadth has basically collapsed.

So what we are witnessing is an end of cycle melt-up in ALL risk assets at the same time, amid daily increasing odds of recession. All accompanied by mass denial that it's the end of the cycle.

Many pundits have been saying recently that as long as the twos/tens didn't invert that the rest of the yield curve inverting did not mean recession. Well, now they are wrong, because twos and tens just inverted:

"Some analysts say that the Treasury yield curve has been distorted by the Fed's massive bond purchases, which are holding down long-dated yields relative to shorter-dated ones"

[There is only one problem with that hypothesis which is that the Fed is no longer buying bonds]

"Analysts say that the U.S. central bank could use roll-offs from its massive $8.9 trillion bond holdings to help re-steepen the yield curve if it is concerned about the slope and its implications"

This last part is the dumbest thing I've read in a while. The Fed's asset purchases aka. QE inflate markets and increase reflation expectations. The Fed's asset unwind aka. QT does the opposite - it tanks asset markets and it increases deflation expectations. So how could it possibly steepen the yield curve?

But here is the key takeaway all bulls were waiting for:

"The time delay between an inversion and a recession tends to be, call it anywhere between 12 and 24 months"

Still plenty of time for gambling, so says Wall Street.

Which gets us to the casino:

At today's close, the NDX (not shown) was RECORD overbought going back to 1998.

Here is the Nasdaq Composite with the Nasdaq breadth oscillator:

As I said above, NYSE breadth is the most overbought since June 2020. Which is the last time bond yields spiked this amount. After that reflation trades (Energy, Financials, Industrials, Transports) imploded.

Crude has tested the 50 dma twice. If it breaks, next support is -25% lower at the 200 dma. With far greater potential downside if that breaks.

Recession stocks are leading the end of cycle rally.

Go figure.

In summary:

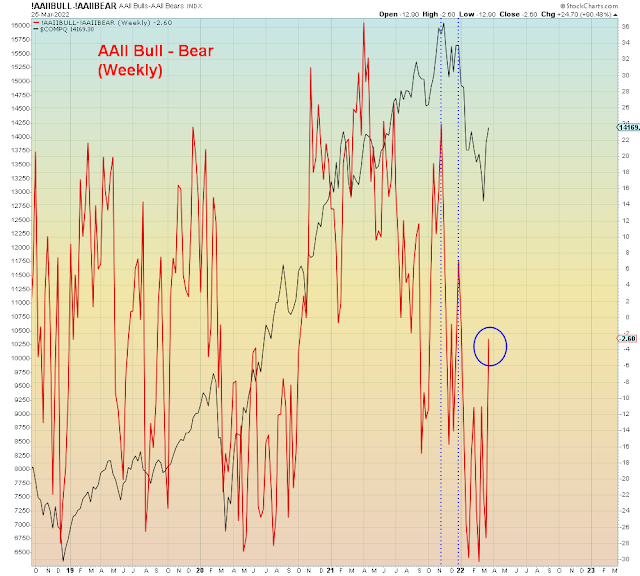

Here we are back at multi-year overbought. The epic risks of the last three months were sold by the smart money institutions who raised cash. Therefore knowing what we know now. Buy or sell?

If you had been bearish and you wish you had been bullish, here's your chance. And if you had been bullish, and wish you were bearish, you can now flip.

BUT, this time EVERYONE knows the risks.