Sunday, November 14, 2021

Common Prosperity

Saturday, November 13, 2021

A World Of False Promises

This society now believes that printed money is the new El Dorado. Recessions and bear markets have been banished to the dustbin of history, replaced by consumption binges and effortless speculative profit. The only question is why didn't anyone try this sooner? What fools! Pundits are basing their current views of the economy upon recent widespread panic buying encouraged by ubiquitous industry pimps; which will be a swan dive into pavement when panic buying turns into panic selling...

Let's begin with this just ending climate conference COP26. The conference has just barely ended and yet people are already realizing that it was just another load of false promises. Which is more cynical, to NOT believe in man made climate change, or to believe in it but not do nothing about it? This climate conference is an analog for the global economy. It's a massive false promise for the future predicated upon the favoured approach of doing nothing. We have discovered the new El Dorado, printed money. Now featuring consumption orgies and speculative manias where there used to be recessions and bear markets. The only question today's pundits have is why didn't anyone think of this sooner? When the false promises around this consumption orgy explode, then the forced downsizing will do more to reduce carbon footprint than any ten bogus climate conferences.

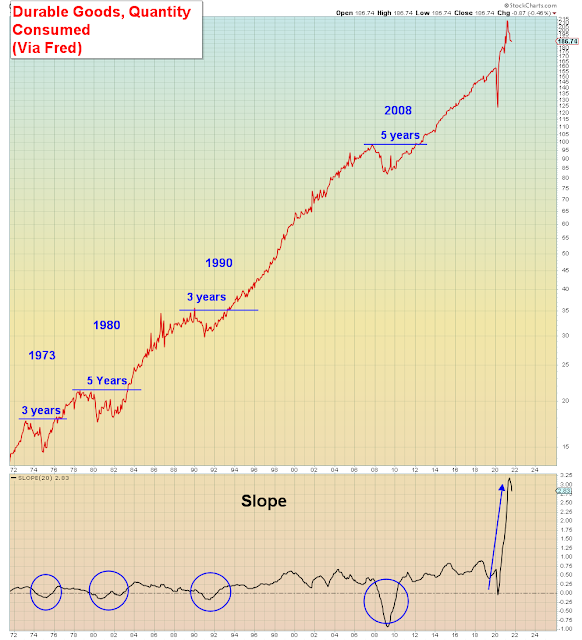

Here we see the pandemic was the first recession in U.S. history in which consumption INCREASED:

But at least we know why the entire $Green energy sector has been on fire lately. Not only was there a climate conference, but also Biden's clean-energy infrastructure bill just passed, and the largest (EV) IPO of the year. ALL in the same week. And the world's richest man rang the cash register several times.

"KA-CHING!!!"

Recapping the economic situation - the pandemic caused a global supply shock which led to higher prices. The initial response was for demand to INCREASE especially for durable goods, cars, and houses. The question is what happens next? Inflationists believe we are in a wage-price spiral that will continue to drive prices higher until the Fed is forced to move or the bond market spontaneously implodes. However, if they are wrong, then we are merely pulling forward consumption from the future and therefore on the verge of the largest and fastest demand shock in U.S. history.

The current "inflationary" view is quite convenient for Wall Street and other industries that are benefiting from panic buying: No one knows when this will end, but it will end badly. Plausible deniability is also the convenient view to ride this year -end melt-up through bonus payout. So, there is tremendous conflict of interest taking place right now.

This article from the former head of India's central bank summarizes the tightrope central banks are walking:

"Former Indian Central Bank Governor Raghuram Rajan highlighted the tightrope that policymakers have to walk with monetary stimulus, warning that one false move may lead to a global “wealth shock” that could scare consumers"

What we notice is that ALL of today's pundits, including Rajan, believe that central banks are STILL in control over global markets. Therefore, they alone decide when this party ends. However, I am not of the belief that they are in control anymore. I believe they have the illusion of control.

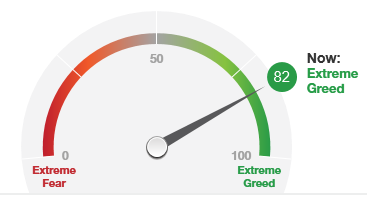

In addition, I believe that this recent panic buying has fed into their backward looking data model and is giving them ALL a false sense of economic confidence. In other words, these are misleading indicators for the future. When we see that consumer confidence has now reached a decade low in this most recent reading, understand that these pundits can't afford to be wrong this time.

Case in point, Jim Cramer says he is going to use this week's retail earnings to get a "feel" for the consumer. What he is going to see is that sales and profits are up this past quarter, and therefore he's going to assume that consumer confidence is solid.

Whereas we already know it's collapsing. We also know that wages are not keeping up with prices. Which is very likely why the bond market is not reacting to the latest inflation news.

In summary, this era reminds me a lot of 2007. It's an industry game called "Dance while the music is playing" aka. Musical chairs.

Wednesday, November 10, 2021

Overinvested In Collapse

Slavish adherence to Supply Side Economics made it inevitable they would not see demand collapse. What this mass delusion is leading to is an inevitable super glut and overinvestment in everything. For today's true believers in Fed bailouts, calling this crash a "policy error" will be cold comfort...

If you notice, there isn't one pundit right now saying this is the end of cycle. To even say that is strictly verboten and could cause massive panic. These people all believe that central banks have permanently banished the business cycle. To be sure, the past 13 years of deflationary Japanification have been the longest uninterrupted debt accumulation cycle in U.S. history. Hyman Minsky never predicted the depths of deflation that would allow interest rates to remain pinned at 0% indefinitely.

Be that as it may, the bet right now is that this largest of all debt/speculation cycles continues forever.

It's as simple as that.

Those who are in the "inflation" camp are of the belief that there will be no Minsky Moment to pop this asset bubble and force mass de-leveraging. And yet ironically it's inflation that NORMALLY causes the Minsky Moment to occur. Were it not for the continuous importation of deflation, this runaway fusion reactor would have exploded a long time ago. Way back in late 2014, hedge fund manager Hugh Hendry predicted the day would come when central bank managed Disney markets would explode, but he also predicted that few pundits would see it coming. He believed they would be "drugged by the virtual simulation of prosperity and its acolyte QE".

And he was right.

My opinion and the opinion of very few others is that not only is the Minsky Moment at hand, but that the inflationary bias of today will make the outcome far worse. Why? Because the inflationary instinct is to hoard assets and accumulate debt. Whereas the deflationary mindset is to shed assets and shed debt. This inflation hysteria which is reaching a crescendo right now has the masses panic buying everything. Which is a colossal mistake. They should be raising cash right now. We are on the verge of a super glut. In everything.

Again, this mistake was made in 2008 and few seem to remember the outcome. Back then, the Fed initiated QE for the first time in history. This time they are already pumping liquidity at the highest rate in history. Back then they had 5% interest rate buffer, this time they have 0% interest rate buffer. In addition, this asset bubble has levitated not only the traditional economy, but it has simultaneously inflated the virtual economy Tech bubble.

What we are witnessing is the Pyrrhic victory of the virtual economy which began in the 1990s with the Dotcom bubble and Web 1.0 and went into final overdrive during the pandemic. Which is why I am calling this late stage melt-up the hyper asset bubble. Ironically, technology and automation are highly deflationary factors, because they increase supply without increasing demand.

There are many sub-sectors within Tech that saw a one-time extraordinary burst of demand during the pandemic: Cloud-based systems. Streaming content platforms. Crypto currencies. Electric Vehicles. Video games. And at the center of it all semiconductors. And all of that Tech demand was further super-charged by record amounts of cheap capital to fund all of the various Silicon Valley start-ups predicated upon the "internet of everything". The idea that we could all sit at home and have the world catered to our front doorstep. The only problem is this limitless growth fantasy has a last mile problem. It requires humanoids to physically deliver the merchandise. And unfortunately there are only so many of those to go around.

There is only ONE real supply chain shortage that won't easily be solved by this supply side hyper-growth model, and that is the labor supply. For ALL the reasons - early retirement, inflated 401ks, crypto Ponzi gains, work/life balance - the humanoids are going offline. Which gets us to peak Amazon. That company is now the largest employer in the U.S. and they can only continue to grow by bidding employees away from other Tech companies. Which means that they face slowing growth AND declining profit margins at peak valuation.Which is what they warned about in their most recent quarter two weeks ago.

But no bubble is quite as ludicrous as the electric vehicle bubble. EVERY car maker in the world produces electric cars already or coming to market in the next few months. Car and Driver lists every electric vehicle coming to market. There is nothing new or unique about electric cars anymore, they are commodities now. The only thing that's unique is the ludicrous market premium accorded these electric car companies. Today, the largest IPO of the year Rivian went public at a $100 billion valuation. They have $0 revenues and are running well over $1 billion in annual losses. Compare that to Ford which has $135 billion in revenues and several electric cars ALREADY in the market. And a lower market cap of $80 billion. There will be a massive glut of electric cars on the market a year from now.

And a massive glut of everything else as well.

Today we were told that the market tanked because of the 30 year high CPI print. But guess which sector was down the most?

Oil stocks.

Why? Because inflation is always highest at the end of the cycle.

Tuesday, November 9, 2021

Delusion Is Transitory

Gamblers sitting on record unrealized gains at all time highs, now face the ticking time bomb of a Fed and Congress that will continue to remove monetary and fiscal stimulus until the market explodes. Why? Because the delusion implied by record asset prices is that everything is going fantastic. Therefore today's strategy of waiting for reality to catch up with fantasy isn't going to work this time...

This entire endgame gambit is compliments of the enduring economic myth of the jobless consumer. Now featuring record low total employment. Denialists are of the belief that the middle class can be plundered relentlessly without consequence, which has led to today's record divergence between asset prices and the economy.

Yes, I realize that prices have risen at a fast pace year over, just as they fell last year at a record pace. Although I don't recall hearing too much concern when that happened. Oil negative? Awesome. Much of what passes for today's "inflation" is due to one-time effects such as post pandemic inventory re-stocking, Christmas panic buying, rampant profiteering/price gouging, and of course record speculation in everything.

Case in point, "high" gas and oil prices are a total fabrication. Nominal prices of gasoline and oil are back at 2014 levels, far below the 2008 all time highs. CPI-adjusted prices are even lower. Using year over year price increases to describe "inflation" is highly disingenuous, and therefore unquestioned.

https://www.eia.gov/petroleum/weekly/

What would you rather have a 200% increase in oil to $150 or a 700% increase to $85? Based upon today's logic, the majority would find the former far preferable.

What it all points to is the fact that this Third World aspirational society has conflated a declining standard of living for "inflation". The critical question on the table when recognizing inflation versus deflation at the macro level is: are debt burdens rising or falling? Inflation benefits borrowers at the expense of lenders. Whereas deflation benefits lenders at the expense of borrowers. We are clearly in the latter paradigm as liabilities both on balance sheet and off balance sheet for households are increasing. The collapse in consumer sentiment is an indication that price elasticity is high and therefore demand is highly sensitive to changes in price.

The lethal question is whether or not this is sustainable. Because if it IS then inflationists are right. But if it's not, then it points to recession amid record asset values.

No wonder they're in denial.

Which gets to the primary risk we now face: Monetary policy is no longer functioning. We are now witnessing a record divergence between asset prices and the economy. Which means that the long-term outcome of monetary policy is exactly what one would expect: Lowering short-term interest rates to 0% has incentivized maximum debt accumulation. While lowering long-term interest rates to 0% has incentivized maximum risk exposure. Which is why we now have a massively leveraged economic time bomb with an asset market fuse attached to it.

Inflationists can be "right" so long as the bomb never detonates. And then terminally wrong from that point forward. All the while blaming "policy error" for their lack of foresight.

Which gets us to the casino.

What I see is a blow-off top within a blow-off top. This latest ramp from the early October lows is the blow-off top for the COVID rally. The COVID rally is in turn the blow-off top for the entire post-2008 rally.

But really, who would know better about these risks than the people who created them in the first place?

"The central bank also said that fragility in China’s commercial real-estate sector could spread to the U.S. if it deteriorated dramatically"

Evergrande Faces Biggest Test To Date As Wednesday Payment Deadline Looms

What gamblers need now is a time machine. Because once they realize they doubled down on a decade worth of risk landing in the fourth quarter, they will be competing with algos to get out the door into a bidless market.

Saturday, November 6, 2021

We Have Now Reached Terminal Idiocracy

Whenever things go pear shaped for this Idiocracy, dedicated amnesiacs look around for the proximate cause of the problem and who to blame. Because, otherwise it was all going so well. Unfortunately, what these people are assiduously ignoring is 40 YEARS of policy error...

Forty years of Supply Side Voodoo Economics later and we are now mainlining monetary heroin into crypto Ponzi markets to cover up the imploding economy. The policy error began decades ago when greed was conflated as a national ideology. What began as a business imperative to maximize corporate profit somewhere along the line jumped the Maslow hierarchy of needs to become the meaning of life.

There are so many open frauds taking place right now that it's impossible to keep track of them all. Congress is now instructing the SEC to make a spot Bitcoin ETF a priority.

You can't make this shit up.

"Bitcoin spot ETFs are based directly on the asset, which inherently provides more protection for investors"

What we see below is that crypto fraud usually peaks after the bubble implodes. This time, it's reaching new highs BEFORE the bubble explodes. Think about what's coming next with respect to fraud discovery.

This gas station owner is trying to prevent fraud on a micro scale by warning senior citizens away from his station's Bitcoin machine.

"Amarjit Singh says since the machine was placed in his store three months ago, he's noticed 12 seniors coming in to buy bitcoin because they thought they had to pay a [falsified] fine to the RCMP"

It's true that Wall Street is the ultimate scam machine. Nevertheless, joining them in their criminal gambit is not the best way forward. This year we've seen record crypto scams, SPAC scams, IPO scams, and every other type of scam.

When this all explodes with biblical dislocation we know this Idiocracy will look around for who to blame, never once thinking to look themselves in the mirror. According to these lifelong aspirational morons, we are now to believe that a global pandemic has improved the global economy hence justifying record valuations in everything. You have to be brain dead to believe it, hence it goes largely unquestioned.

Even more lethal, is this fake inflation theme which is essentially at this point unquestioned. This pandemic was the most deflationary event in world history. It shut down the global economy. It shut down global travel. It has kept people away from their offices for almost two years now. It blighted small business, restaurants and shopping malls, and it essentially imploded the job market. Economists can't figure out why serial mass layoffs keep leading to lower labor participation each time.

Two of the worst managed and most leveraged multinationals in the world - GE and Boeing - combined laid off tens of thousands of aerospace workers last year. These are some of the most highly skilled workers in the U.S. These are not baristas and burrito assembly line workers.

Now, shockingly aerospace companies have a MASSIVE labor shortage. Why? Because it turns out that intelligent people don't want to work for the same assholes who laid them off.

No pundit saw this coming:

"Against that backdrop, it’s tough to imagine many qualified employees being keen to favor the aerospace manufacturers that dumped them when the going got tough. It doesn’t help the sales pitch that Raytheon prioritized a $2 billion share buyback this year over keeping more workers on the payroll"

On Friday we just got the first hot payroll number in several months. It appears the termination of Federal pandemic UI finally gave a boost to corporate hiring. Nevertheless, bond yields TANKED on Friday. As I showed on Twitter, bond yields have fallen (t-bonds rallied) EVERY TIME the has Fed tapered QE. And yet STILL pundits are shocked by this occurrence and are therefore now crying policy error. It's either that or admit they've been wrong all along.

Why are bond yields rolling over? Because the Fed is taking liquidity out of markets and hence inflation expectations are falling. And THAT is driving bond prices higher. Unlike the late 1970s when the U.S. middle class was at its apex, now the labor share of the economy and capacity utilization are at all time lows. In addition, we now have MILLIONS of workers missing from this fake recovery.

Late on Friday, the House finally passed the trimmed down Biden infrastructure bill. Too little, too late. Now markets will experience reduced fiscal AND monetary stimulus at the same time. AND a potential debt ceiling/shutdown in just a few weeks deja vu of the 2018 clusterfuck.

In other words, we have very likely witnessed peak reflation.

Against this backdrop Transports have "confirmed" this latest all time high, now more than five decades overbought. Trolls inform me it's all due to Avis. No it's not it's due to vertical Tesla and Ford, all things EV, record auto parts companies, Autonation, record railroad companies, and record trucking stocks.

I feel like a high school teacher with the stoners at the back of the class waking up to tell me I'm wrong.

And so it is that here comes the REAL Whack-a-Troll.

Thursday, November 4, 2021

The Last Pump And Dump

Tuesday, November 2, 2021

DENIALISTIC SUPERNOVA

Fittingly, today's gamblers are now trapped by their own monetary-induced imagined reality, where they are easy prey for a society of used car salesmen running amok. The lesson NOT learned in 2008 about trusting proven con men, is coming home to roost...

What we are witnessing is an infantile regression from fact and reality. Personally, I no longer react to climate change denial. Why? Because you see it as much now at these climate conferences as you do anywhere else. One side actually believes that Exxon is giving everyone beach front property, while the other side attends climate conferences which spew out non-stop empty promises. Really, who is more cynical?

The fact remains that a relatively innocuous pandemic did more to move the needle on climate change than any ten conferences. COVID was a wake up call that the modern consumption lifestyle is over. It was the most deflationary event in world history. So what did the Consumption Borg do? They went ALL IN on a massive consumption binge at the end of the cycle. The outcome of which will be collapsed demand and a glut of everything.

We now have known demand pull forward in housing, autos, technology/semiconductors, and durable goods. Of course there WAS a time during the pandemic when manufacturing stopped and inventories were depleted. However, since the global economic restart, supply chains have been overwhelmed by restocking. The port of Los Angeles is now handling record volumes to play catch-up.

Ironically, the pandemic-driven increase in online shopping has meant unprecedented new warehouses built across the U.S. These new warehouses must all be stocked which is further increasing demand.

"America has long been gobbling up more goods from overseas than we send back, but in the past year, spending has gone bonkers. Stuck at home and unable to buy services like haircuts and massages, and unable to travel and eat out as much as they’d like, Americans bought even more stuff, filling their ever-larger houses. The U.S. imported $238 billion worth of goods in September, up 15% from September 2019"

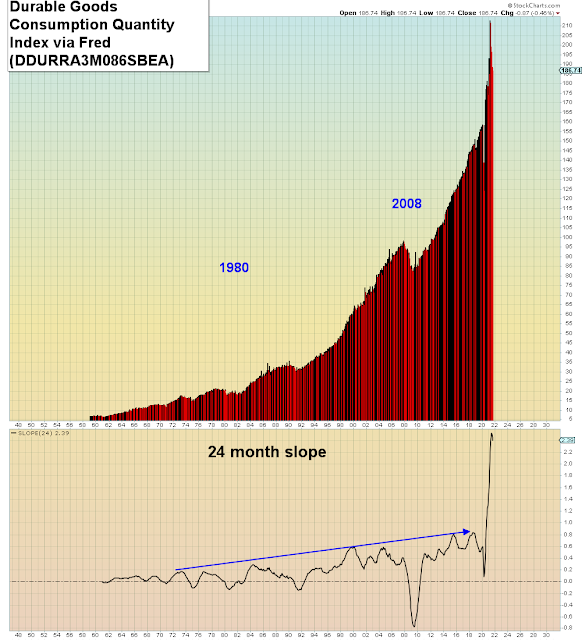

This is a chart of durable goods which I showed on Twitter. We are to believe that this is the "new normal" for demand:

What this surge of demand and restocking clusterfuck has done is it has enabled RECORD profiteering and price gouging, under the auspice of "inflation". Those who have been fanning the flames of inflation hysteria have succeeded in creating human history's largest buying panic in everything.

Here we see the TRUE inflation is in corporate profits which just rose 35% in ONE YEAR. Which is equal to the % gain over the prior 13 years since 2007.

Why is it that these inflationists only complain about rising wages not rising profits? They're assholes, that's why. Here we see that once again mass layoffs are extremely accretive to profit:

Similar to the Y2K date change, Tech stocks just saw a massive ONE TIME increase in computer spending by corporations due to the pandemic. Which is now baselined into corporate earnings. After Y2K it took 18 years for Tech stocks to return to their prior highs. I predict the same will happen now as these mega cap Tech behemoths reach record market cap amid stalling earnings at an unsustainable plateau.

In summary, I predict this will be the fastest and most violent collapse in demand in U.S. history. This buying panic and its lagged indicators of inflation are now concealing a nascent collapse in demand as consumer sentiment hits decade lows. Every company missing revenue estimates this quarter is blaming supply chain problems while ignoring retreating demand. As is their norm, economists will realize the economy has collapsed about a year after it happens.

In the meantime, gamblers continue to make their suicide run in reflation trades. What we are witnessing in real-time is the inevitable death of supply side economics wherein the economy collapses while the misallocation of capital skyrockets amid rampant delusion.

Monetary induced imagined reality propagated by a cabal of used car salesmen running amok.

Don't try this at home.