"Ackman said he made his new hedge on the day that Pfizer announced its promising new COVID-19 vaccine. Pfizer’s announcement was “actually bearish,” Ackman said, predicting that it will prompt Americans to grow complacent about mask-wearing, allowing the deadly virus to spread even more widely."

Sunday, December 6, 2020

The Big Long 2021

"Ackman said he made his new hedge on the day that Pfizer announced its promising new COVID-19 vaccine. Pfizer’s announcement was “actually bearish,” Ackman said, predicting that it will prompt Americans to grow complacent about mask-wearing, allowing the deadly virus to spread even more widely."

Saturday, December 5, 2020

2021 Prediction

Below I lay out how I see the coming year playing out from this point forward...

The first order event is an impending "correction" from record overbought levels and this persistent delusion that 2021 will bring a global recovery - both of which are central bank sponsored fabrications. On the other side of that "Black Swan" event we will be confronted with mass panic and of course yet more lying as usual. If it's one thing we've learned over the past decade it's that an aging society can't handle the truth. McDonald Trump will forever be known as the lying president.

To give an idea as to the magnitude of this delusion, here we see that the Global Dow has now equaled its 2016/2017 tax cut rally in one third the time. Under the ubiquitous belief that the post-pandemic economy will be better than the pre-pandemic economy. Human history's biggest denialistic fantasy.

Overall I predict that 2021 will be the year when even the most delusional morons begin to recognize the chasmic divide between fantasy and reality. The cracks in the facade will be too wide to ignore with printed money. Ultimately, faith in Wall Street, economists, pundits and politicians will collapse.

I believe this first order crash will be violent and panic-inducing, but ultimately create a sharp rebound similar to 1929. A rebound that could last a matter of months - somewhat of a mini version of what we just saw this past year.

In other words I think that the 1930s analog of soaring and crashing markets has already begun. Each rally will be weaker and less believed than the last. But central banks won't give up without a fight. What we have learned over the past decade is that you can rent delusion but you can't own it long term. However, we should be mindful of the fact that the return on pump and dump will diminish over time, as capital depletes itself on false rallies.

"Investor bullishness is flashing a “code red,” wrote Michael Hartnett, chief investment strategist at Bank of America. He points to the firm’s proprietary Bull & Bear Indicator “accelerating toward extreme bullish”

"Buy the dip"

With central banks bidding and crashing global markets in the backround, the continuously imploding economy will be the ultimate arbiter of this impending reset. I suggest that we have already seen peak employment for the next several years. Meaning that economic erosion will accelerate from this point forward. Nevertheless, the ideological paradigm shift to a fully reflationary economy is still not yet visible on the horizon. It will take a matter of extreme market dislocation to create ideological paradigm shift and sadly central banks are doing everything possible to prevent that from happening:

The next key economic events in the road to reflation are the Senate runoff in Georgia in January, the vaccine rollout, and the inauguration. By the spring the full impacts of COVID winter and all of the other deflationary factors should become fully evident, notwithstanding the spring thaw and the vaccine rollout. To believe that everything will bounce back to normal is the greatest delusion of all. Some habits have changed forever. Some industries may never fully recover to their pre-pandemic levels. Once economic reality is fully revealed months hence, then markets and the economy should get fully in synch to the downside, until such time as the ideological paradigm shifts to middle class bailout on a MASSIVE and ongoing scale. By that time corporate defaults will be well underway and bond markets will be in no mood for a yield spike.

Many people are now throwing around this term "reset" on both sides of the political spectrum. Lunatics on the far right see this as another conspiracy to tighten George Soros' grip on the world economy. What all of these people left and right have in common, is that they have not even the slightest clue how brutal and uncontrolled this event is about to become. It will be far from a planned and coordinated event. And when the smoke clears, billionaires will not be the prime beneficiaries.

Which gets us to the true Black Swan risk, and most obvious outlier to all of these forecasts for 2021. The greatest risk is faith in the Disney market itself.

Over time these Disney markets have become more and more fraudulent and fragile. Which is why the rallies and crashes have become more violent. We saw multiple limit down moves in March and several day session trading halts. Multiple brokerages experienced outages. If it's one thing all of these 2021 linear predictions are forgetting it's that record capital imbalances and a record rush to risk will test these Disney markets to the limit. And when they break, then confidence in markets will be destroyed sooner rather than later. If that happens you can be certain that my prediction above is far too sanguine. Those who believe that TRUE market reality is impending, and positioned accordingly will be vindicated. In other words, tail hedges are recommended.

Here we see the difference between the 2016/17 tax cut rally and this monetary fabrication in 2020. Realized volatility has remained high all this year.

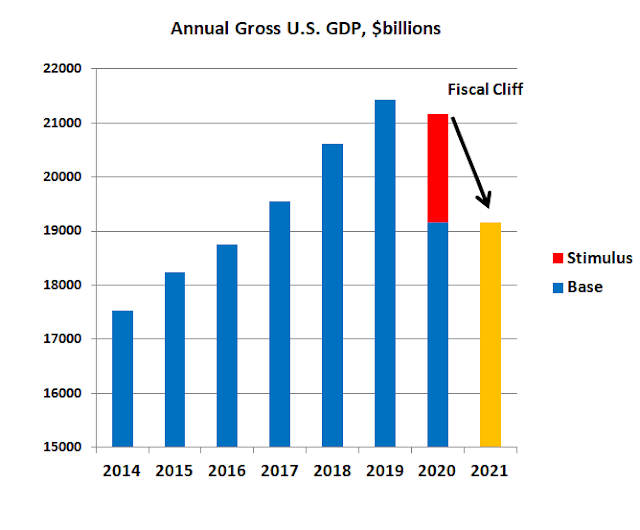

Because after all, take away these stimulus gimmicks and all you're left with is a bear market in an accelerating depression, cleverly disguised as a buying opportunity. So the question for 2021 is how long will that delusion last?

Gamble at your own risk.

Friday, December 4, 2020

The Future Is Deflationary

Thursday, December 3, 2020

The Golden Age Of Fraud

Wednesday, December 2, 2020

Sucker's Rally aka. Bull Trap

"Airbnb Inc. and DoorDash Inc. earlier this week raised the terms for their initial public offerings as a stock market rally indicated investors might be willing to spend more to boost returns."

"Global stocks face a potential $300 billion headwind heading into year-end: portfolio rebalancing."