Global depression, uncontrolled pandemic, existential election, mega Tech bubble. No matter how bad things get, the burden of truth will always fall on us skeptics of Disney markets. Because for the rest, there is undying faith in easy money and central bank market manipulation. Which is what has led today's gamblers to take ever-greater risks. Central banks have sponsored a tremendous fear of missing crash "FOMC":

mor·al haz·ard

"lack of incentive to guard against risk where one is protected from its consequences"

With respect to options speculation and manipulation, this was the biggest FOMC rally of the entire cycle:

Bullshit markets have a way of sucking in otherwise fairly intelligent people. Which is why, statistically speaking "no one sees this coming", far too many otherwise intelligent people got onboard. One thing I've noticed is that this era's bears - as few and far between as they are - tend to get less bearish as the market rises. They are so busy getting trolled by morons telling them they are wrong, that they begin to lose conviction. It's called capitulation. And we are going to see it over and over again in the coming months and years.

My overall hypothesis remains that the Tech bubble is now final imploding and it will detonate MOAC: Mother of All Crashes. As I wrote last weekend, this renewed decline will make the March decline seem like a picnic. Featuring futures limit down and limit up moves, day session trading halts, ETF flash crashes, and offline brokers. Central banks will be powerless to stop the explosion once it begins. However, I expect massive short-term rallies the likes of which we have never seen before. Followed by renewed crashes. In other words epic volatility. When the dust settles the public will have lost all confidence in Disney markets. Yes, I mean it.

So far, the path of this top and implosion are similar but not identical to the February top. Below I will indicate the similarities and differences.

First off, it's clear that most of today's gamblers were not around in Y2K, or if they were they have late stage dementia. Because the vast majority of people today can't recognize a Tech bubble when they are buying one with both hands. History will say that the broader market imploded at the COVID top in February, and the resulting crash set off a final deflationary rotation to Technology "safe havens" aka. Jim Cramer's COVID19 index. The broader market of economic cyclicals never even remotely confirmed the new "bull market".

When the market became more and more skewed towards mega cap Tech stocks, it exploded at high altitude.

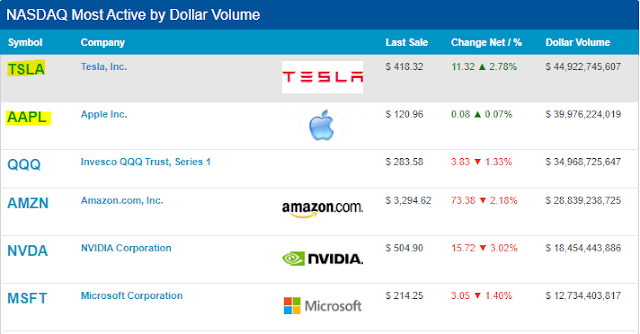

Last week, the Cramer COVID19 stocks got monkey hammered:

Most of today's pundits are already calling this a mere correction in a new bull market. Of course the future is uncertain, so when any selloff begins it can be anything anyone wants it to be, and in the age of con men that is a lethal proposition. So far, the technical indicators are too vague to convey the magnitude of what is coming.

Which is why we need to step back and consider this situation in the broader context. If this were a technical correction which is formally defined as -10%, then on the Nasdaq it should already be over by now, because the Nasdaq tagged -10% down on Friday morning. Here below we see that relative to the 200 day moving average, the Nasdaq remains more overbought than it was at the February top. Which means that if we use my definition of a correction - tag back to the 200 day moving average - which is a routine occurrence in any bull market, then this "correction" is only half over.

The next point I would make is that this is a Global Tech bubble, not just a U.S. Tech bubble. Many of these mega cap Tech companies trade on multiple global exchanges around the clock. We also see that this bubble has been record overbought for almost three months now. In comparison to the February top, this one is vastly more overbought and it has lasted far longer, which by today's Idiocratic logic means it will continue forever and end happily ever after.

But it's in the re-entry to the atmosphere where it's going to get dicey for Major Tom. Because the higher these mega caps fly the harder they land. This past week Apple reached $2.3 trillion in market cap - more than the entire Russell 2000 and more than the London FTSE 100. Then we found out later in the week it was mostly due to market manipulation.

Here we see Apple remains record overbought and 30% above the 200 day moving average. Notice that realized volatility (lower pane) is skyrocketing:

As I write Monday morning Labor Day, the S&P futures are clinging to the breakout above the February high as Europe catches up with the Friday afternoon rally in the U.S. Tonight should be far more interesting with everyone returning from summer vacation. Going back to my posts from the February top, I was interested to recall the uncanny similarities between then and now around market manipulation using options. Back on Thursday February 27th on day six of the initial crash, one of the charts I showed was of Momentum Tech and how it had been soaring and crashing around weekly options expirations. Below is the current view of those same stocks. As we see they have been pounding support for two months now since early July:

In summary, today's pundits are convinced that economic fundamentals, logic, and facts no longer matter to Disney markets. Central banks can control any and all scenarios as they arise. Unfortunately, what they forget is that you can only go ALL IN once. And the way that central bank alchemy works is that it incentivizes fools to take unwise and irrational risks. Until they explode without warning. Rinse and repeat. Until there is no one left to implode.

As we now know the majority of today's active money managers and financial advisors got suckered big time by Softbank using options manipulation to rig the Tech bubble. Now, however, the blood is in the water and everyone knows it was a massive con job. Getting out of these positions will be a lot harder than getting in, including for Softbank. Because notwithstanding Zerohedge's valiant attempts to intellectualize stupidity, every speculator since the beginning of time has dreamed of bidding up their own positions. For some reason today's PhDs can't understand, it never works.

Ultimately one ends up being their own greater fool.