Hard to believe, I know...

Sadly, in an Idiocracy, there is no strength in numbers. When today's Idiot Class finally accepts the fact that their leaders are as dumb as they are, the underwear will be PERMANENTLY stained:

Sadly, in an Idiocracy, there is no strength in numbers. When today's Idiot Class finally accepts the fact that their leaders are as dumb as they are, the underwear will be PERMANENTLY stained:

From an economic standpoint, Trump's entire presidency will be remembered for its ever-greater abuse of stimulus, driving an ever-greater speculative bubble.

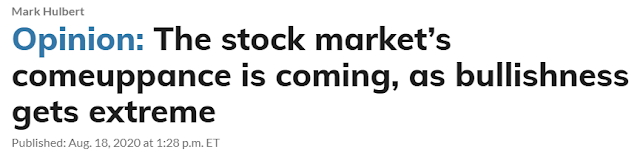

Which went late stage full retard this past week:

Social media? Reality TV? Dumbphones? Corporate fake news? Or some combination of the above. I will leave to the archaeologists to determine how this happened, however, needless to say the Idiocracy arrived 500 years ahead of schedule:

"An American soldier takes part in a classified hibernation experiment, only to be accidentally frozen for too long and awaken 500 years later in a dystopian world where commercialism has run rampant, mankind has embraced anti-intellectualism, and society is devoid of such traits as intellectual curiosity, social responsibility, justice, and human rights"

Bueller?

Now we are inundated with dumbfuck conspiracy theories. When the intellect is entirely collapsed and the recollection of history is non-existent, enter conspiracy theories to explain how we got here. We couldn't possibly blame it on personal irresponsibility, mass consumption, and epic greed.

Unfortunately for these dullards, history won't be as dim-witted. It will place their existential gullibility at the epicenter of collapse. Useful idiots. History will view this era as the sum total of bad decisions that took place over decades. The over-commercialization of society to the benefit of ever-fewer people. Culminating in human history's largest leveraged buyout. Leaving the traditional bagholders holding the bag at the end of the cycle.

Speaking of idiots, central banks don't have control over markets, they only have control over copious fools and their misallocation of capital. First Japan and then China learned the hard way the limitations of trickle down Ponzinomics. Now it's Europe and America's turn.

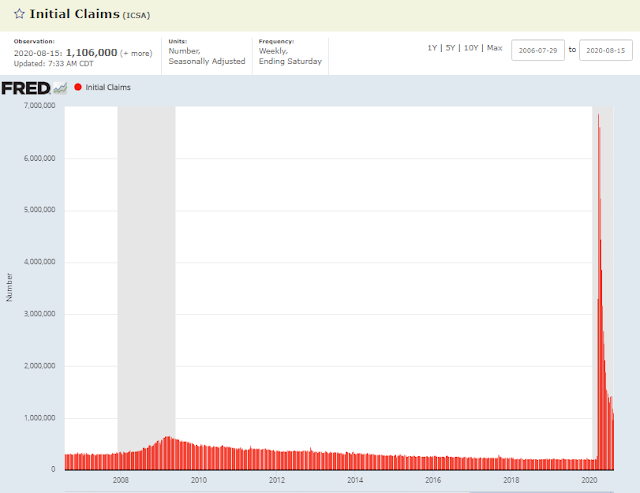

When the markets crashed in March the Fed was concerned that the debt mega bubble was imploding, so what to do but bailout lenders, again. This is their only strategy - to prop up the supply side of the debt bubble. Borrowers were left to the vagaries of Congress. At first, the COVID collapse was well funded on the fiscal/demand side, however now since the beginning of August that demand side support has collapsed.

Which leaves an EVEN bigger debt bubble than before and even worse insolvency on the part of borrowers. And yet there is no concern on the part of those holding these inflated (bond and stock) assets.

This is what copious Ponzi schemers buying "stocks" at all time highs were telling themselves this week:

“The $600 top-up in unemployment benefits is critical for those getting the funds, but its absence means less to overall retail spending than many opine...More critical to the revival in retail spending is the recovery in the equity market, a recovery itself owed to the Federal Reserve"

It’s not just the well-known “wealth effect” that comes from seeing one’s one portfolio doing well that keeps the economy humming, Blitz noted. More critically, the stock market’s performance is what he calls “a conveyor of confidence.”

Indeed, a conveyor of false confidence. A Jedi Mind Trick for weak minded dunces.

Below we see that back in February as bond (prices) rose, the dollar (black) fell in inverse proportion. As these two assets moved in opposite directions, "real yields" temporarily fell, as inflation expectations rose in line with risk assets. It was believed as now that the dollar is doomed due to inflation. However, the only inflation was in asset prices, debt and of course latent insolvency. Now we see the same thing on a larger scale, except today there are millions of people unemployed and their stimulus has run out.

When the asset bubble bursts, not only will the "wealth effect" implode, but Ponzi-levitated reflation expectations will instantly collapse, as will confidence. The dollar once again will explode higher.

And then those who believe that "stocks", fake wealth, and fake confidence are more important than incomes will learn the hard way that they are lifetime idiots.

Speaking of exploding asset bubble, the story of the week of course was the continued out-of-control rallies in Apple and Tesla. What these two stocks have in common, aside from being late stage parabolic, is that they both have an impending stock split. This week Apple cleared the $2 trillion mark and kept rolling - this Monday is the date of record for their upcoming stock split. For Tesla, the date of record was yesterday (Friday).

We have never seen a "market" more dependent upon a miniscule handful of parabolic stocks. Combined, these two stocks traded 8x more dollar volume than the Nasdaq 100 ETF (QQQ):

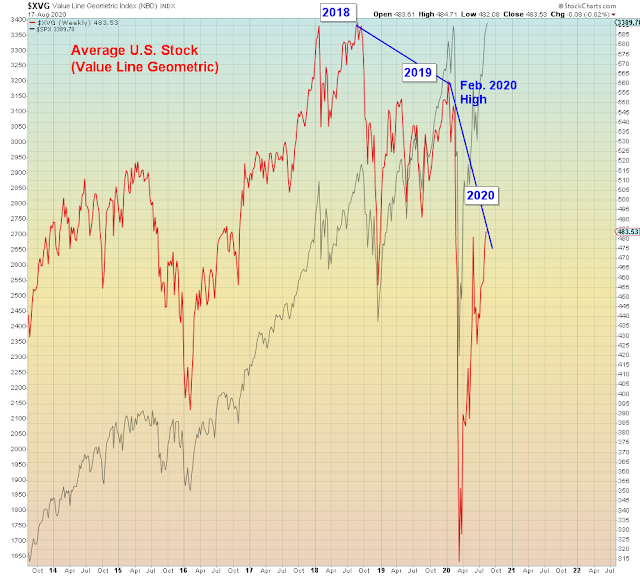

And yet we saw the exact same pattern in February. Whereas the S&P 500 is roughly the same level, Tesla is over 100% higher than the February peak. To give an idea of the interim increase in market leverage:

As another example, here we see the Momentum stocks as a whole took 3 months to obtain the same level they achieved in 13 months last year. Since reaching the February crack high, they have continued to melt-up higher:

Even as these last Momo stocks soar, here we see Nasdaq breadth has already rolled over deja vu of prior peaks.

For most of this past week breadth was negative on both the NYSE and the Nasdaq.

Economic cyclicals have left the building

Granted, not everyone got fooled

Option skew measures the extent to which out of the money put options are higher priced relative to call options.

"The CBOE Skew IndexSM - referred to as "SKEW" – is an option-based indicator that measures the perceived tail risk of the distribution of S&P 500 ...Tail risk is the risk associated with an increase in the probability of outlier returns, returns two or more standard deviations below the mean. Think stock market crash, or black swan"

Skew peaks before the market, then the weak bears get rinsed and it makes a lower high at the actual rollover.

What it all points to is an algo-driven central-bank Frankenmonster momentum rally that is now totally out of central bank control. They achieved their purpose of misallocating epic amounts of capital.

Once again, copious fools believe that central banks can stop margin calls, stop losses, and flash crashes despite the fact that capital is now 100% RISK ON. We learned this week that at this new overthrow fake high, short interest is lowest on record.

Picture short interest at an all time low, in a bear market which is about to go third wave down at ALL degrees of trend.

I predict that by the end of this dislocation even today's biggest clowns will no longer be seeking the advice of fellow dumbfucks.

I predict that by the end of this dislocation even today's biggest clowns will no longer be seeking the advice of fellow dumbfucks.