Most gamblers seem to forget that central banks including the Fed and PBOC were lubricating markets massively ahead of the first COVID crash in March of this year. The Fed was busy monetizing Trump's massive Treasury issuance in order to keep the overnight repo market under control. Remember the repo crisis? That started exactly one year ago in August 2019. It was caused by the financing of Trump's massive tax cut deficit which was crowding out the sovereign credit market and otherwise imploding global liquidity. Until the Fed stepped in to monetize the deficit. Which drove the FOMO bubble into the February highs.

Good times.

Good times.

Fast forward to now, and the amount of central bank lubrication is beyond any prior comparison. Which is why this bubble is reminiscent of the February melt-up except on an even larger scale.

Central banks have once again succeeded in creating a one-way market. One in which the only asset class is momentum. This last bubble is running on MAGA glue fumes and attendant mythology. The primary myth being that the GOP will agree to bailout the middle class ahead of the election. An asinine fantasy if there ever was one. Which is why, amid a de facto collapse in stimulus, gamblers are STILL hanging their massively leveraged bets on further dramatic monetary and fiscal stimulus. An outcome that ironically has been made far less likely due to the front-running of central banks into risk assets.

Here we see corporate bonds have now exceeded their February highs:

ESG - alternative energy, solar, environmentally sustainable funds - are another bubble going parabolic:

For their part, money managers have no choice but to believe in this delusion. Performance anxiety requires them to believe whatever fraudulent narrative is on offer, no matter how specious. They are as a group, merely trend following chimps. Closet indexers.

On the subject of gold, we are told that gold is at a new all time high. Below we see gold adjusted for inflation. What we notice is that not only is gold NOT at an all time high, but it's also three wave corrective. We also notice via the lower pane that Fed balance sheet expansion does not always correlate with rising gold prices. Note the expansion in 2012 during which gold had its largest decline in decades.

Those of us who predicted the repo bubble would burst spectacularly, were not disappointed. It was the largest and fastest drawdown from a market top in U.S. history. Nevetheless, the scale of this COVID bubble makes that one look miniscule by comparison.

And of course, the stakes are much higher this time around, given that central banks are now ALL IN. And given that the global economy has been pre-imploded.

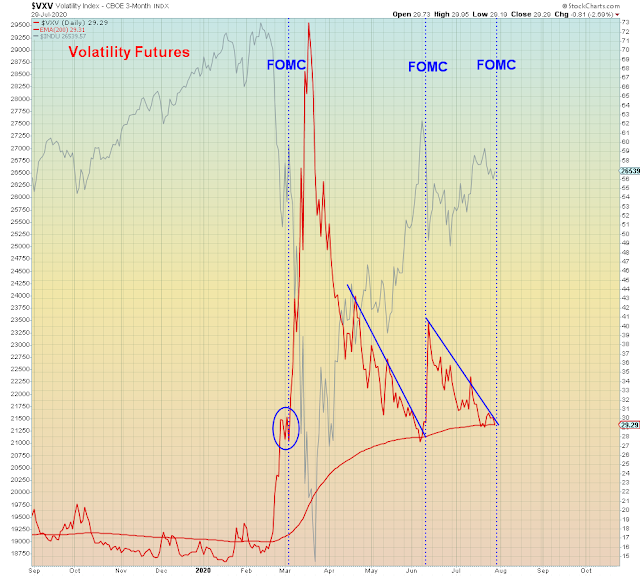

Fed Chief Jerome Powell has previously admitted that the Fed is essentially "short volatility". Meaning they are actively encouraging the suppression of risk premia to give the illusion of a low risk financial environment.

This volatility suppression strategy is what creates a binary market. Volatility is artificially suppressed until such time as capital accumulates maximum risk.

And then it all explodes out of control.

In the meantime - which as we have learned can take quite some time - epic lies are bought and sold at the behest of those who traffic in financial chicanery.

They don't have the facts or reality on their side, however, given enough misallocated capital they can rent prosperity for a while.

Move along, nothing to see here:

What history will say about this MAGA larceny: